This article is brought to you by Standard Chartered Singapore.

Standard Chartered Singapore has launched the new Journey Card, packed with a range of great benefits; plus, a great sign-up bonus giving cardholders more than enough miles for a Business Class flight to Japan/South Korea!

Earn Rates

Receive uncapped earn rates of 1.2 miles per dollar (mpd) on SGD spending and 2 miles per dollar on foreign currency spending.

Bonus: Get 3 mpd on Groceries, Food Deliveries and Ride-Hailing

From now till 31 December 2023, cardholders can also enjoy a higher earn rate of 3 miles per dollar on groceries, food deliveries and ride-hailing services!

Receive this earn rate on eligible spending, up to S$1,000 per statement month; no minimum spending required!

Awesome: Uncapped Foreign Currency Fee Rebates

During the months of November and December 2023, Standard Chartered Journey cardholders will get an uncapped 3.5% cash rebate on foreign currency fees!

Along with an uncapped earn rate of 2 mpd on foreign currency spending, there is no doubt that this is the best card for all spending in foreign currency during those months!

Sign-Up Bonus

For a limited time, applicants of the Standard Chartered Journey Card can receive up to 45,000 bonus miles + S$80 cash.

💡 Bonus miles awarded are on top of the base miles that you would earn while hitting the minimum spending requirement! In other words, cardholders would get a further 3,600 to 9,000 miles, depending on the spending category (1.2 to 3 mpd).

That’s potentially enough miles for roundtrip Business Class flights to Japan/South Korea!

P.S. Read on to find out how you can get 1,000 free miles just by signing up for a Frequent Flyer Program.

This sign-up bonus is only available to applicants who do not currently have a Standard Chartered credit card as a principal cardholder, and those who cancelled their last Standard Chartered credit card at least 12 months ago.

Here’s a breakdown of how you can receive those rewards:

| Bonus Reward | Condition | Apply by |

|---|---|---|

| S$60 cash (via PayNow) | – | 1 Oct 2023 |

| S$20 cash (via PayNow) | Put card-on-file & spend min. S$20 at participating merchants within 30 days | 1 Oct 2023 |

| 35,000 miles (87,500 points) | Spend min. S$3,000 within 60 days | 30 Sep 2023 |

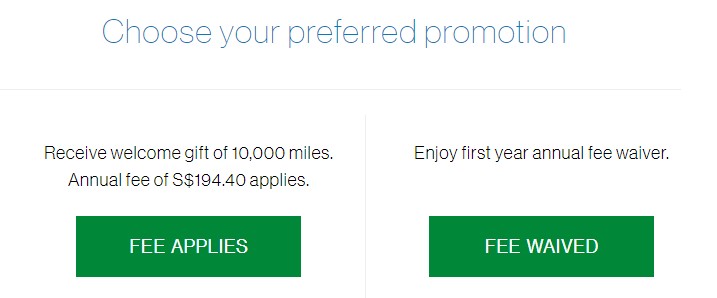

| 10,000 miles (25,000 points) | Pay first-year annual fee of S$194.40 | 30 Sep 2023 |

📜 35,000/45,000 miles terms and conditions

📜 S$60 + S$20 cash terms and conditions

How are Miles Credited?

Miles earned on this card are awarded as Rewards Points, which can be converted into Miles in future (2.5 points = 1 Mile).

It is worth noting that Rewards Points are awarded for every dollar spent on this card, unlike cards from certain banks which only award miles/points in S$5 blocks!

- SGD spending: 3 points per dollar (equivalent to 1.2 mpd)

- Foreign currency spending: 5 points per dollar (equivalent to 2 mpd)

For example, upon spending S$100 in foreign currency, cardholders will be awarded 500 Rewards Points, which can be converted to 200 Miles in future (2 mpd).

When are Miles Credited?

Base Rewards Points are credited immediately when a transaction is posted. This typically takes 2 to 4 days from the transaction date.

When do Miles Expire?

There are 2 expiry terms that travellers should be aware of; one of the credit card, another of the Frequent Flyer Program (FFP).

Good news, Rewards Points earned on the Journey card do not expire! This gives cardholders fantastic flexibility to leave the points in the account for as long as they want, and only transfer them to an FFP when they are ready to make an award redemption.

Once converted, miles will adopt the expiry term of the respective FFPs. Here are the expiry terms of popular FFPs used by Singapore-based travellers:

| Frequent Flyer Program | Expiry Term |

|---|---|

| Singapore Airlines KrisFlyer | 3 years |

| EVA Air Infinity MileageLands | 3 years |

| KLM/Air France Flying Blue | 2 years* |

| Qantas Frequent Flyer | 18 months** |

*Expiry term resets every time a paid SkyTeam flight is credited to the account. Miles do not expire for Flying Blue Silver, Gold and Platinum members.

**Expiry term resets every time there is account activity (e.g. earn miles from flights, redeem miles for award flights or transfer miles from credit cards). In other words, miles will not expire as long as there is account activity.

Free Airport Lounge Access

Cardholders receive two free airport lounge visits per card membership year, via Priority Pass.

This is a useful benefit as travellers can use it for a quick meal, get some work done or relax before their flight.

Priority Pass lounge entitlement can also be used at selected restaurants for free meals!

Great Miles/Points Transfer Partners

Another thing that makes the Standard Chartered Journey Card stand out from others is its list of transfer partners. As award seat availability is not guaranteed, it is hugely beneficial to have options across multiple Frequent Flyer Programs!

Additional note: Each points conversion, regardless of the amount, costs S$27.

Here are the frequent flyer and hotel loyalty programs that you can transfer your points to:

| Loyalty Program | Conversion Ratio (card → partner) |

|---|---|

| Singapore Airlines KrisFlyer | 25k points → 10k miles |

| EVA Air Infinity MileageLands | 2.5k points → 1k miles |

| KLM/Air France Flying Blue | 2.5k points → 1k miles |

| Qantas Frequent Flyer | 2.5k points → 1k miles |

| IHG One Rewards | 2.5k points → 1k points |

| Etihad Guest | 3k points → 1k miles |

| Qatar Airways Privilege Club | 3.5k points → 1k Avios |

| United Mileage Plus | 3.5k points → 1k miles |

| Emirates Skywards | 3.5k points → 1k miles |

| Accor Live Limitless | 5k points → 1k points |

Complimentary Travel Insurance

As an added bonus, cardholders can receive complimentary travel insurance with coverage up to S$500,000.

To qualify, charge all of your travel conveyance fares (e.g. flight tickets) to the card.

$10 Grab vouchers to/from Changi Airport

From now till 31 December 2023, cardholders can receive S$10 off Grab rides to or from Changi Airport! Enter promo code SCCHANGI under the Offers section of the Grab mobile app to apply the discount.

Cardholders can redeem this offer a maximum of 5 times and the promo code is limited to the first 2,000 redemptions. That’s S$50 worth of Grab vouchers per cardholder!

Eligibility and Fees

The Standard Chartered Journey Card has an annual income requirement of S$30,000 for Singaporeans and PRs; S$60,000 for foreigners.

The card comes with an annual fee of S$194.40. This can be waived for the first year. As mentioned above, cardholders may also opt to pay the first-year annual fee to receive an additional 10,000 miles.

Best Ways to Redeem Miles from Standard Chartered Journey Card

As mentioned above, cardholders enjoy great flexibility with miles earned on the Standard Chartered Journey Card as they do not expire and can be transferred to a number of useful Frequent Flyer Programs.

As there is no FFP that is perfect for everyone, it’s good to understand which ones are better for the routes that you are aiming for!

Additional note: Award seats are not guaranteed and award bookings come with varying taxes/fees. Be sure to check for availability and the total costs via each FFP’s website, before converting your credit card points.

Let’s have a look at the best routes to redeem the miles earned on your Standard Chartered Journey Card.

Singapore Airlines KrisFlyer

Although KrisFlyer miles can be redeemed for flights on partner airlines, they are best used for Singapore Airlines-operated flights, where there are no fuel surcharges imposed on award flights.

Here are the best routes to redeem your KrisFlyer miles:

| Region (one-way, to/from Singapore) | Economy Class (miles) | Premium Economy (miles) | Business Class (miles) | First Class (miles) |

|---|---|---|---|---|

| Istanbul, Dubai, S. Africa | 29k | 43k | 56.5k | – |

| Auckland, Christchurch, Sydney, Melbourne | 30.5k | 51k | 68.5k | 93.5k |

| Perth, Darwin | 21.5k | – | 40.5k | – |

| India, Maldives, Sri Lanka, Nepal | 20k | 34.5k | 43k | 58.5k |

| Hanoi, Manila | 13.5k | – | 24k | – |

| Bali | 8.5k | – | 21k | – |

EVA Air Infinity MileageLands

Infinity MileageLands miles can be redeemed for flights on EVA Air or with its partners (for a little more miles) like Singapore Airlines, Turkish Airlines and All Nippon Airways.

💡Pro tip: Get 1,000 free Infinity MileageLands miles when you sign up and complete your profile!

Here are the best routes to redeem your Infinity MileageLands miles:

| Region (one-way, to/from Singapore) | Economy Class (miles) | Premium Economy (miles) | Business Class (miles) |

|---|---|---|---|

| Japan, S. Korea, Taipei, Mainland China | 17.5k | 20k | 25k |

| Europe | 50k | 55k | 75k |

| North America | 50k – 55k | 55k – 60k | 75k – 80k |

KLM/Air France Flying Blue

Flying Blue miles can be redeemed for flights on KLM, Air France or on partner airlines like Garuda, China Airlines and Qantas.

Here are the best routes to redeem your Flying Blue miles:

| Region (one-way, to/from Singapore) | Economy Class (miles) | Premium Economy (miles) | Business Class (miles) |

|---|---|---|---|

| Jakarta | From 7.5k | – | From 15k |

| Perth | From 16.5k | – | From 55k |

| Sydney, Melbourne | From 25.5k | – | From 61.5k |

| Europe | From 38k | From 50k | From 70k |

| North America | From 35k | From 65k | From 135.5k |

Qantas Frequent Flyer

Qantas Frequent Flyer points are great for flights to/from Australia and New Zealand.

Here are the best routes to redeem your Frequent Flyer points:

| Region (one-way, to/from Singapore) | Economy Class (miles) | Premium Economy (miles) | Business Class (miles) | First Class (miles) |

|---|---|---|---|---|

| Australia, New Zealand | From 18k | From 51.3k | From 57k | From 102.6k |

| Europe | From 37.8k | From 81.8k | From 90k | – |

Bottom Line

Miles/Points flexibility is very important in the Miles Game; and the Standard Chartered Journey Card gives you just that, with its non-expiring points and multiple transfer partners.

Cardholders also get to enjoy an uncapped 3.5% cash rebate on foreign currency fees in the vacation months of November and December 2023, while still getting an uncapped earn rate of 2 miles per dollar.

If that’s not enough, there is also a bonus earn rate of 3 miles per dollar on daily expenses like groceries, food deliveries and ride-hailing. Plus, up to S$50 worth of Grab vouchers to/from the airport and complimentary travel insurance to further sweeten the deal.

And oh, let’s not forget about the generous sign-up bonus of up to 45,000 miles + S$80 cash that new cardholders can receive with this card. 🤯

Click here to apply for the Standard Chartered Journey Card!