I’ve had an annual fee waiver request accepted at the second time of asking for the DBS Woman’s World Mastercard this week.

Keep track of your card anniversary

Here’s a quick reminder to keep track of your credit card anniversary dates as most (from Singapore) are simply not worth paying annual fees for.

The easiest way is to set a reminder on your calendar and have basic information of your cards in a spreadsheet (click here to get our free template).

| Subscribe to Suitesmile on Telegram to be the first to know about amazing deals and travel hacks. It's FREE! |

| Subscribe |

How to request for annual fee waivers for DBS cards?

It is very easy to request for annual fee waivers for DBS/POSB credit cards as you can do it via the self-service function on the internet banking website.

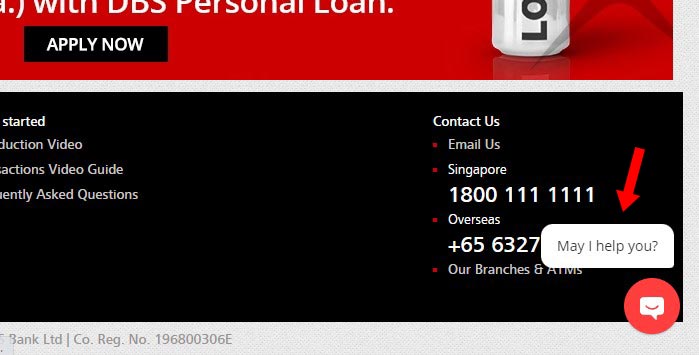

1) Click on the digibot chat icon

After logging into your account, locate the “digibot” chat icon on the bottom right of the page and click on it.

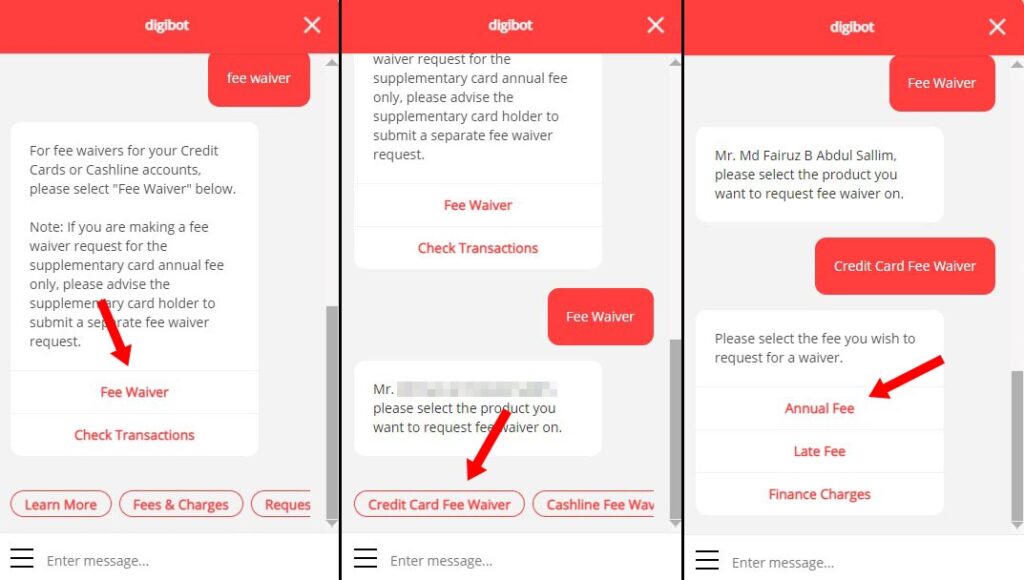

2) Select credit card annual fee waiver on digibot

To select annual fee waiver on DBS digibot, follow these steps:

- Type “fee waiver” and press enter

- Click on Fee Waiver

- Click on Credit Card Fee Waiver

- Click on Annual Fee

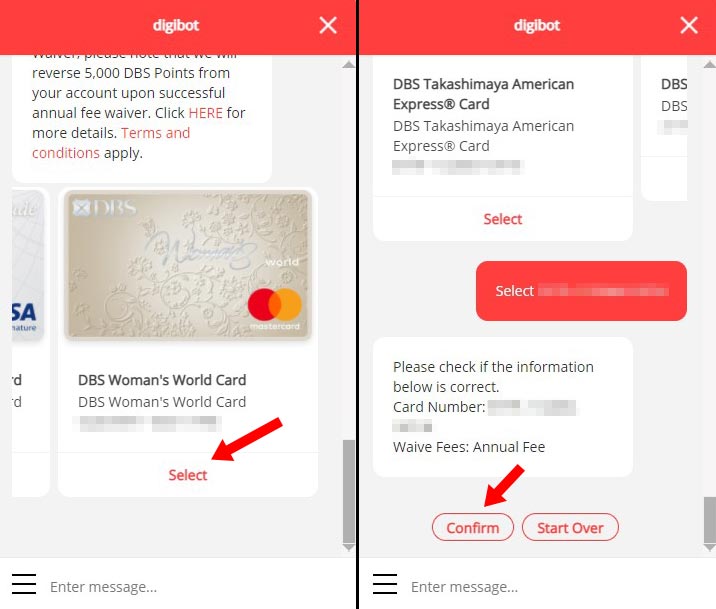

3) Select your credit card

Next, select the credit card that you would like to request an annual fee waiver for and click on confirm.

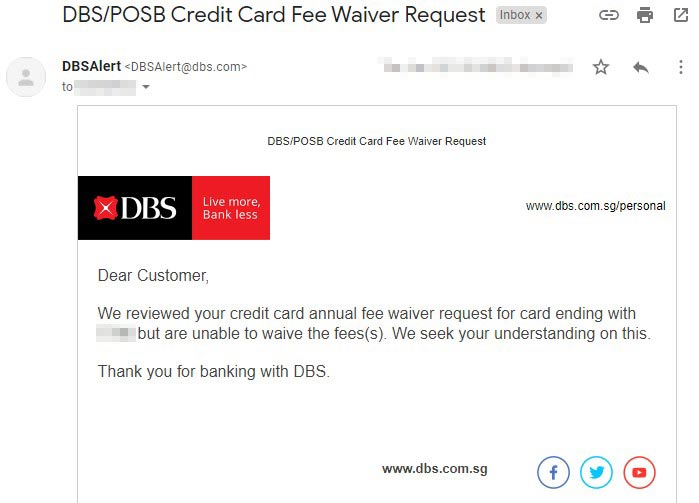

4) Receive an email on the outcome

You should receive an email on the outcome of your request in 2-3 business days.

| Subscribe to Suitesmile on Telegram to be the first to know about amazing deals and travel hacks. It's FREE! |

| Subscribe |

5) What if the request is rejected?

If the annual fee waiver request is rejected, call DBS at 1800 111 1111 to request for an appeal. To do this, you will need to speak with a customer service officer and it shouldn’t take more than a minute.

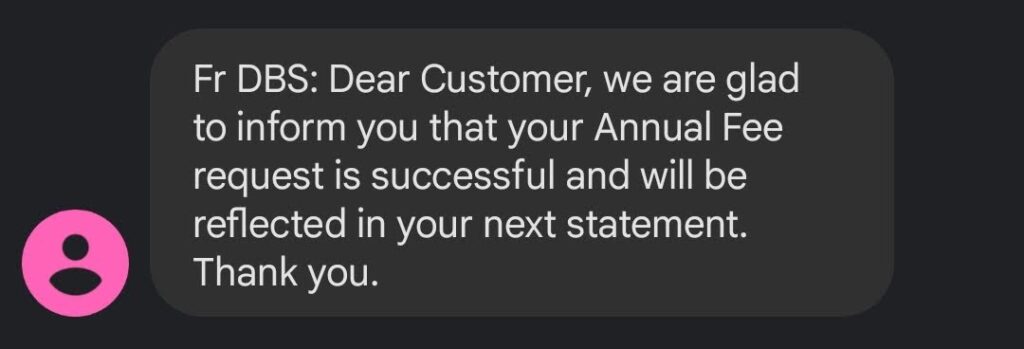

6) Receive an SMS on the outcome

You should receive an SMS on the outcome of your request in 2-3 business days.

If it is successful, the annual fee amount that was charged to your card will be reversed within a week or so.

Would I have paid the annual fee if the appeal was rejected?

Absolutely not!

DBS Woman’s World is one of the best credit cards in Singapore, IF it is free to hold. Paying an annual fee of S$192.60 takes away a lot of value from the card, especially when it doesn’t come with additional miles/points.

Related: Best cards in Singapore for online spending

In my opinion, Citi Prestige is the only credit card in Singapore that is worth paying an annual fee for, because of its unique benefits. But even that is barely worth it!

Bottom line

It’s great to be able to get an annual fee waiver on this great card despite having very low spending over the past year.

Before you cancel the card when an annual fee waiver is rejected, know that you can make 1 last attempt!

Hi can assist to waiver off my credit annual fees for DBS Master platinum card

When should I request the annual fee waiver? Before or after it posts to my account?

I usually request for it when it appears as an unbilled transaction.

Thank you!

Hi

Is it possible to wavier annual fee that is paid in mar 22

Hi, I am not sure about that. Best to ask DBS.