42 credit cards that I have cancelled over the years

In February this year, we offered $350 cash for Citibank’s new credit card and just last month, Apple AirPods with wireless charging case (worth $299) for Standard Chartered credit cards. We have not seen guaranteed sign-up bonuses better than those in Singapore, ever. What’s incredible is that none of those cards require you to actually use them or pay annual fees in order to receive your cash/gifts.

Cancel credit cards that you do not use

Since the launch of Suitesmile just 5 months ago, I am happy to have increased awareness of the opportunities to earn extra cash from credit cards. On top of that, I also shared how to use the right cards for your day-to-day spending to receive maximum miles and points to fund future travels. This is nothing new to some of you veterans but it’s great to see newbies learning how to use credit cards to their advantage.

It is easy to get carried away with credit card sign-ups when you see free cash and gifts every where. A lot of times, all you have to do is just sign-up, activate and put the card in the drawer. You will then receive your cash/gift a couple of months later. I often hear people keeping these credit cards that they do not use for months/years. There are no benefits in doing so. In fact, you may be hit by annual fees and late payment interests after keeping those cards for over a year.

| Subscribe to Suitesmile on Telegram to be the first to know about amazing deals and travel hacks. It's FREE! |

| Subscribe |

Keep records

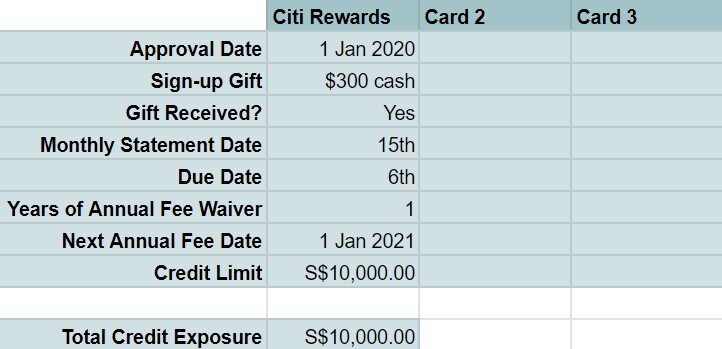

As you sign up for more credit cards, it gets harder to remember the annual fee and points expiry dates as well as the credit limits for each card. For that reason, it is good practice to record those important data somewhere. If you do not already have a spreadsheet for that purpose, I strongly recommend downloading our free copy.

Keep important details of each card

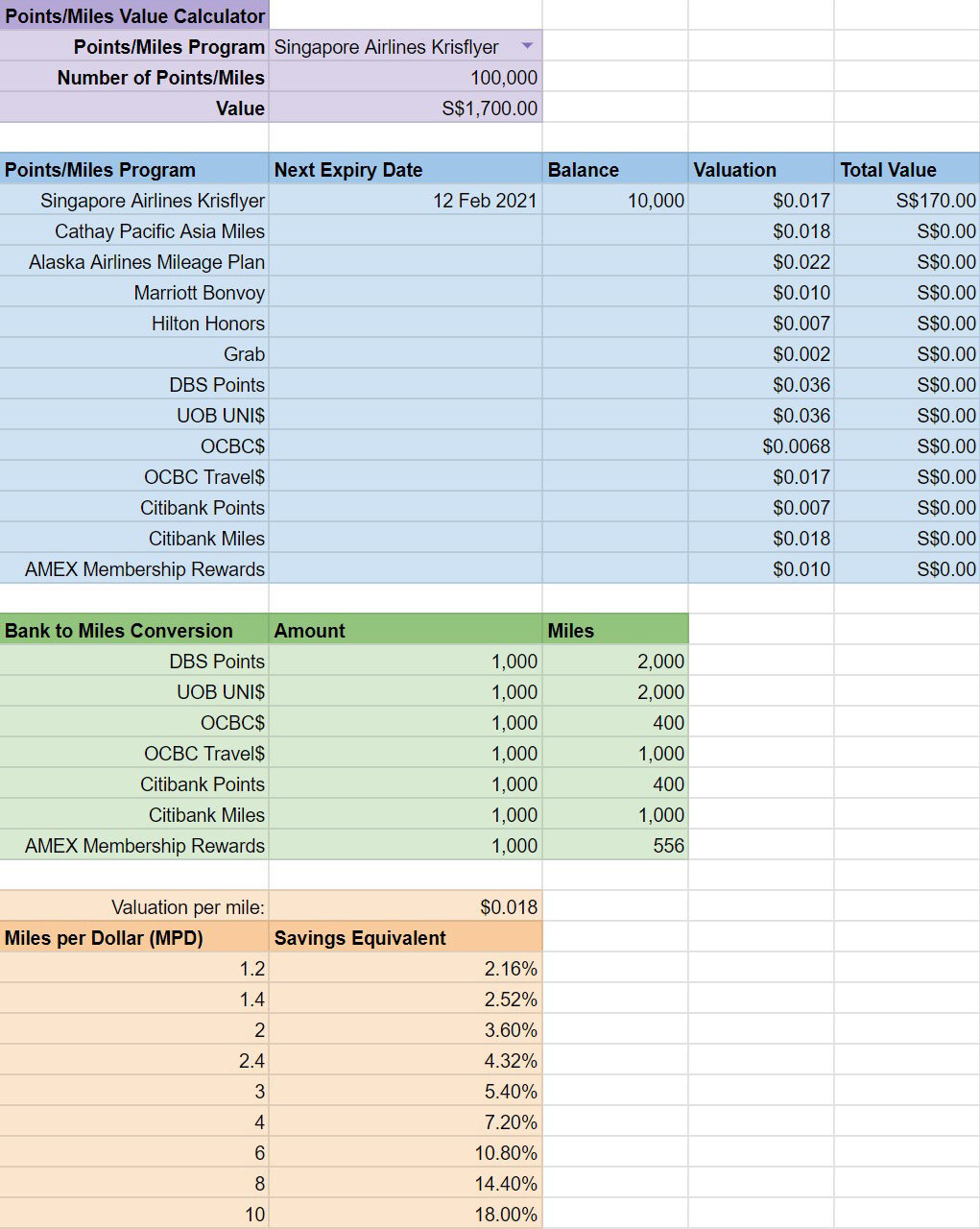

Our free spreadsheet also include useful tools like points to miles conversion, tracking of expiry dates and recording miles/points balances from different programs.

Miles and points tools

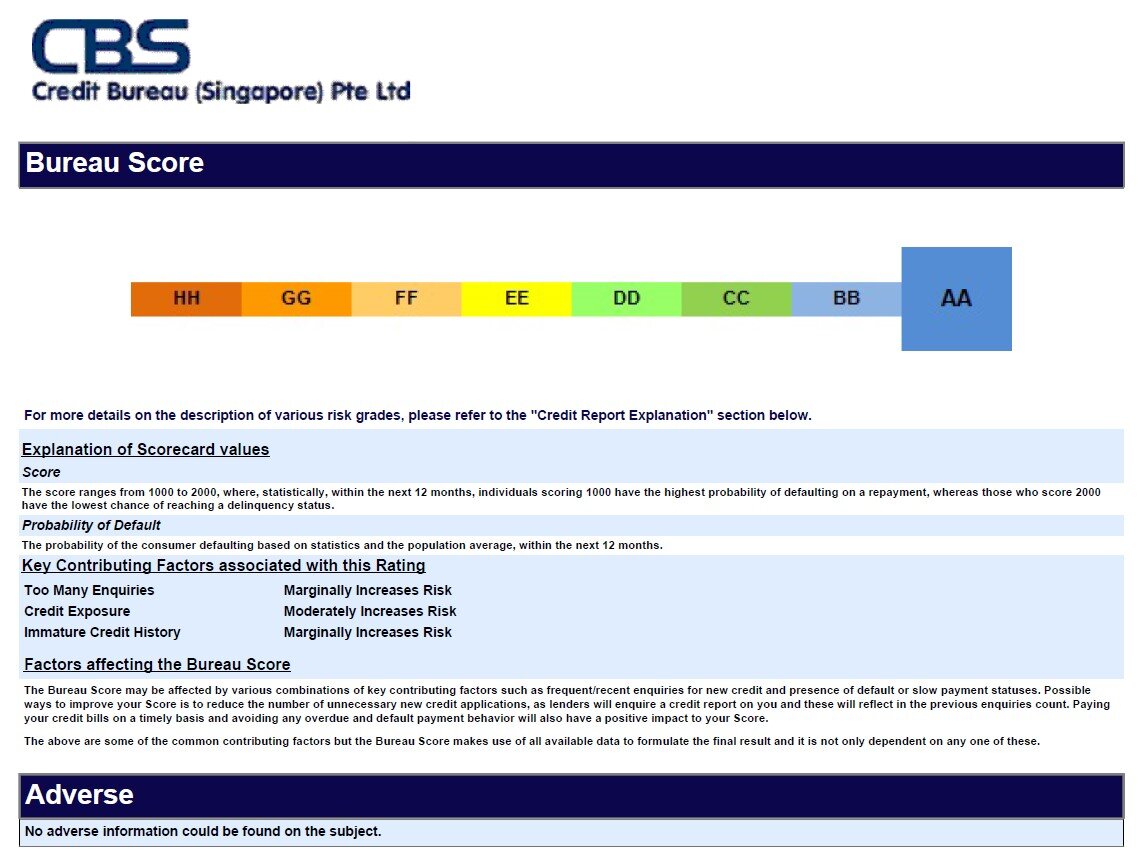

Check your credit score

This is often neglected by credit cardholders. Credit Bureau Singapore provides free credit reports for anyone who has recently applied for a credit facility in Singapore. This free credit report can be obtained for 30 days from the approval/rejection date of a credit facility (e.g. credit card).

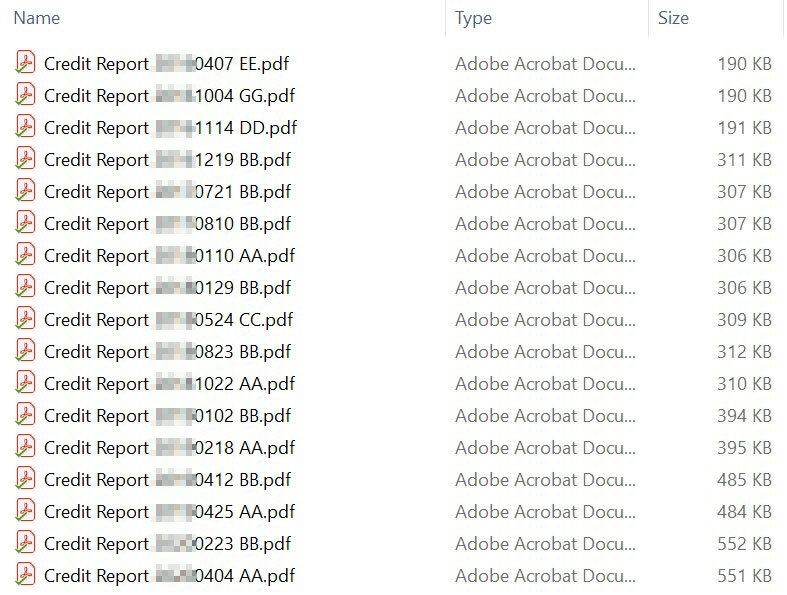

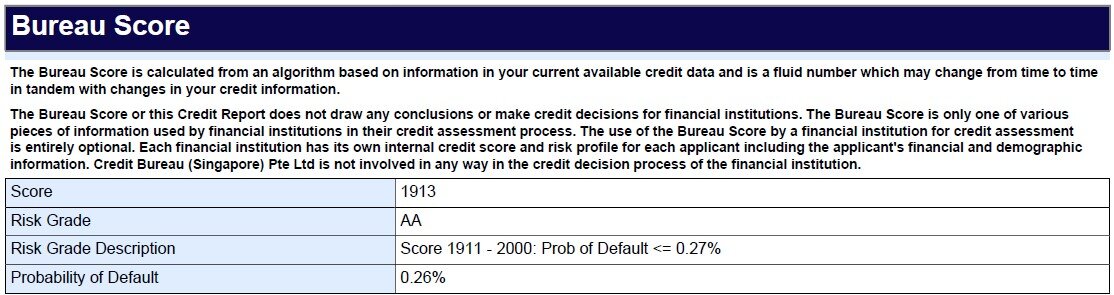

What I like to do is download and save them in my computer periodically to understand how the frequency of my credit card applications are affecting my credit score despite on-time payments. As you can see below, my credit score took a big hit when I applied for about 20 cards at one go. This was partially because of very high credit limits given by banks. It went to DD very quickly as I did not miss any payments. I then called the banks to manually lower my credit limits and that further improved my score to BB. I have shared tips on how to drastically minimize the risk of accumulating credit card debt. If you would like to keep a healthy credit score, the most important one is choosing your own credit limit.

My credit score has been shuffling between AA and BB in recent years depending on the frequency of new credit card applications. I am currently holding on to 15 credit cards and using about 5 of them regularly according to my spend category.

My credit score history over the years

My credit score and risk grade

My risk grade and key contributing factors

Conclusion

As much as it is important to be socially responsible now, it is just as important to be financially responsible and stay within full control of your credit facilities at all times. Enjoy only the free cash and perks. Skip the pain of late payment fees and interests.

Follow us on Telegram, Instagram and Facebook to receive our latest updates.