In this article, I will put the absolute best Online spending cards in Singapore head-to-head, rank them and explain my choices.

General exclusions

In general, most credit cards do not award points/miles for the types of transactions listed below.

(i) annual fees, interest charges, late payment charges, GST, cash advances,

instalment/easy/extended/equal payment plans, preferred payment plans, balance

transfers, cash advances, quasi-cash transactions, all fees charged by Citibank or third

party, miscellaneous charges imposed by Citibank (unless otherwise stated in writing by

Citibank);

(ii) funds transfers using the card as source of funds;

(iii) bill payments (including via Citibank Online or via any other channel or agent);

(iv) payments to educational institutions;

(v) payments to government institutions and services (including but not limited to court

cases, fines, bail and bonds, tax payment, postal services, parking lots and garages,

intra-government purchases);

(vi) payments to insurance companies (sales, underwriting, and premiums);

(vii) payments to financial institutions (including banks and brokerages);

(viii) payments to non-profit organizations;

(ix) betting or gambling (including lottery tickets, casino gaming chips, off-track betting,

and wagers at race tracks) through any channel;

(x) any top-ups or payment of funds to payment service providers, prepaid cards and any

prepaid accounts;

| Subscribe to Suitesmile on Telegram to be the first to know about amazing deals and travel hacks. It's FREE! |

| Subscribe |

The best cards for online spending

Let’s look at the best cards for online spending other than those exclusions listed above. All of these cards are free to apply and annual fees are waived for at least one year.

7) YouTrip Card

YouTrip is a prepaid card that requires you to top up your mobile wallet before using the card for your spending. Your account balance can be topped up using any debit/credit card.

As topping up a YouTrip wallet falls under the general exclusion above, you will not receive any miles/points even if you use a credit card for the top up.

The good

+ No foreign transaction fees

The bad

– No miles/points/cashback.

YouTrip Card

Suitesmile card rating:

Sign-up bonus

–

Key benefit

No foreign currency

fee

Annual fee

No annual fee

Min. Income

requirement

$30,000/yr

6) GrabPay Card

Like YouTrip, GrabPay Mastercard is a prepaid card that requires you to top up your mobile wallet before using the card for your spending. As topping up a GrabPay wallet falls under the general exclusion above, you will not receive any miles/points when using most credit cards for the top up.

However, you will receive up to 3% cashback by topping up your wallet with the American Express True Cashback card.

Points expiry: Will not expire if you make at least 1 Grab transaction every 3 months.

The good

+ 4 Grab points (worth 1 cent) per dollar spent.

+ Below average foreign transaction fee of 2%.

+ Receive Grab points for many categories that are usually excluded for other cards, like hospital, education and utilities.

The bad

– Charges foreign transaction fee when other prepaid cards do not.

GrabPay Card

Suitesmile card rating:

Sign-up bonus

–

Key benefit

A “gateway” card to get

cashback where you

usually can’t

Annual fee

No annual fee

Min. Income

requirement

No income requirement

Apply for this card on Grab’s mobile app

5) OCBC Titanium Rewards Card

OCBC Titanium Rewards Card awards 10 OCBC$ (4 MPD) for every $1 spent on “shopping” online or in-store. I placed the word “shopping” in quotes as it is a very broad term. According to the terms and conditions, clothing, electronic and common online stores like Lazada, Amazon and Qoo10 qualify too.

You can earn a maximum of 120,000 OCBC$ (48,000 miles) per anniversary year. This means that you will be awarded 4 MPD for the first $12,000 that you spend on “shopping”.

Because OCBC only has one transfer partner with limited sweet spots, it is a deal-breaker for me, as long as the other cards below exist.

Points expiry: 24 months from the month they are earned.

The good

+ Annual cap instead of monthly cap makes this card good for larger purchases.

The bad

– Only one transfer partner, Singapore Airlines Krisflyer.

OCBC Titanium Rewards Card

Suitesmile card rating:

Sign-up bonus

$228 cashback

Key benefit

Earn 4 miles per dollar

for online spending

Annual fee

$192.60

(first 2 years waived)

Min. Income

requirement

$30,000/yr

4) UOB Preferred Platinum Card

UOB Preferred Platinum Card is among the best cards to use locally as it awards 4 MPD on most contactless and online spending.

However, the categories, as defined in the terms and conditions, are very specific and depends on the Merchant Category Codes (MCC). In general, you will receive 4 MPD for online stores like Lazada, Amazon and Qoo10 as well as movie tickets and food delivery.

Points expiry: 24 months from the month they are earned.

The good

+ Points can be transferred to Krisflyer or Asia Miles.

The bad

– Limited qualifying categories.

– Points are awarded in blocks of $5.

UOB Preferred Platinum Card

Suitesmile card rating:

Sign-up bonus

–

Key benefit

Earn 4 miles per dollar

for contactless spending

Annual fee

$192.60

(first year waived)

Min. Income

requirement

$30,000/yr

3) HSBC Revolution Card

HSBC Revolution Card offers 4 MPD for online transactions related to travel, retail, supermarkets and food delivery, as described in the terms and conditions.

Although this card is more limiting than the other 2 below, it covers all the important categories for most users.

Some of the categories that will not qualify are: cinemas, hair/nail salons and telco.

Points expiry: 36 months from the month they are earned.

The good

+ Above average points validity of 3 years.

+ Points can be transferred to Krisflyer or Asia Miles.

+ No annual fee.

The bad

– Does not cover all online categories.

HSBC Revolution Card

Suitesmile card rating:

Sign-up bonus

(choose one)

$200 cashback,

Samsonite luggage

Key benefit

Earn 4 miles per dollar

or 2.5% cashback

for contactless and online

Annual fee

No annual fee

Min. Income

requirement

$30,000/yr

2) DBS Woman’s World Card

Despite its name, DBS Woman’s World Card is available to men as well. And despite having an annual income requirement of $80,000 per annum, I know a lot of people who have gotten an approval with an annual income well below that (above $30,000, of course).

The rules for this card are very straight forward. As long as the transaction is not one from the general exclusion list above and is made online, you will be awarded 10 DBS points per $5 spent (4 MPD). However, not all online transactions can be automatically detected. For that reason, you will need to check and appeal via iBanking if points are not awarded for your online spending (e.g. reservation on hilton.com).

For tracking purposes, 1 point per $5 will be awarded around 3 days after the transaction and the remaining 9 points per $5 will be awarded around the 16th of the following month.

Points expiry: 12 months after the quarter that they are earned.

The good

+ Wide coverage of qualifying transactions.

+ Higher monthly limit.

+ Points can be transferred to Krisflyer or Asia Miles.

The bad

– Requires tracking of points.

– Below average points validity.

DBS Woman’s World Card

Suitesmile card rating:

Sign-up bonus

$150 cashback

Key benefit

Earn 4 miles per dollar

for online spending

Annual fee

$192.60

(first year waived)

Min. Income

requirement

$80,000/yr

(not strict)

1) Citi Rewards Card

Citi Rewards Card awards 10 ThankYou Points (4 MPD) for every dollar spent if the online spending is not transport or travel related.

Although this card has more limitations than DBS Woman’s World Card, points from this card are worth 11% more.

Citi points can be transferred to valuable Frequent Flyer Programs from Qatar Airways and Turkish Airlines, which require fewer miles for flights to Europe.

Points expiry: 5 years after card opening.

The good

+ Longer points validity.

+ Plenty of transfer partners.

The bad

– Travel and transport spending are excluded.

Citi Rewards Card

Suitesmile card rating:

SIGN-UP BONUS

40,000 points

(16,000 miles)

Key benefit

Earn 4 miles per dollar

for online spending

Annual fee

$194.40

(first year waived)

Min. Income

requirement

$30,000/yr

What about online spending in foreign currency?

The ranking above leans towards online spending in Singapore Dollars. Banks in Singapore charge between 2.8% to 3.5% in fees for transactions in currencies other than Singapore Dollars.

Let’s look at the following example:

Purchasing a US$100 pair of shoes online (converts to S$135 today)

1) Citibank Rewards Mastercard

Because Citibank charges 3.25% fees for foreign currencies, a US$100 item would cost me S$139.39 today. I would receive 1,390 points which can be converted to 556 miles (worth S$11.12) for this transaction.

2) YouTrip Mastercard

As YouTrip does not charge any foreign currency fees, I would have been charged S$135.

Buying with YouTrip would be S$4.39 cheaper. However, I wouldn’t get any points/miles. With Citibank Rewards, I am essentially “buying” 556 miles for the additional S$4.39 that I am paying.

In other words, I am buying miles at 7 cents each (4.39 / 556). As I value Citibank miles at 2 cents each, this also means that by paying a little more with the right credit card, I am buying miles at a 65% discount.

If I continue using YouTrip for the next 5 years with a cumulative online spending of S$19,000, I would have saved $617 vs Citibank Rewards.

But with Citibank Rewards, I would have earned enough miles for a one-way Business Class ticket to Europe in the amazing Qatar Airways’ Qsuite. This flight ticket typically costs around $1,700.

Here is how I would rank these cards if the online transaction is made in foreign currency:

- Citi Rewards Card

- DBS Woman’s World Card

- HSBC Revolution Card

- UOB Preferred Platinum Card

- OCBC Titanium Rewards Card

- AMEX + GrabPay + YouTrip Combo

- YouTrip Card

- GrabPay Card

What about Cashback cards?

Unfortunately, there are no Cashback cards that offer decent cashback without at least $500 minimum monthly spend.

If you don’t mind the hassle of keeping track of minimum spend every month, here are your options:

| Card | Cashback | Min. spend | Max. spend |

|---|---|---|---|

| Citi SMRT Card (not travel-related) | 5% | $500 per month | $12,000 per year |

| OCBC Frank Card | 4.17% | $600 per month | $600 per month |

| DBS Live Fresh Card | 3.33% | $600 per month | $600 per month |

| UOB EVOL | 3.33% | $600 per month | $600 per month |

| UOB One Card | 3.33% | $500 per month | $2,000 per month |

For some of these cards, you can unlock about 2% more cashback by spending on Contactless payments, on top of Online spending. But your cashback will still be capped at $20 – $30 a month per category.

Welcome to the frustrating world of Conditional Cashback.

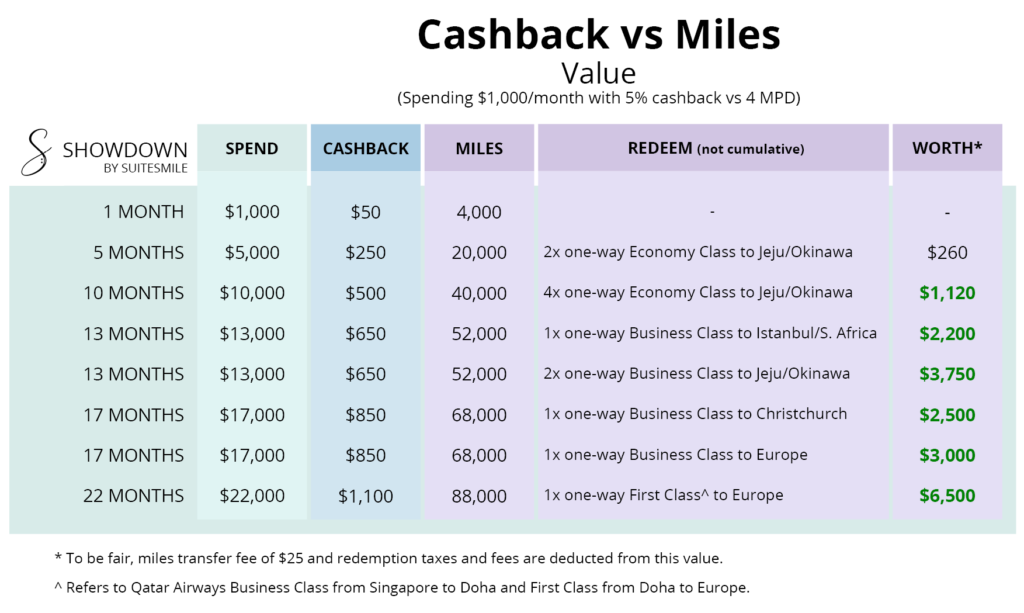

If you need a reminder of why Miles cards are far superior in Singapore (except for fuel spending), have a look at the following table:

Bottom line

There are many things that can be paid online these days. It would be a waste to forgo all the rewards that you can receive, just by using the right cards.

If you would like to make the most out of your online spending, you have to get Citi Rewards Card as well as DBS Woman’s World Card.

Useful articles about credit cards and the Miles Game

As always, I recommend reading the following articles if you are new to credit cards:

- Cashback vs Miles: Which cards are better?

- Getting Started: Is the Miles Game for you?

- Keeping track of your credit cards

- How to drastically minimize the risk of accumulating credit card debt

- Should you pay your credit card’s annual fee?

Visit suitesmile.com/learn for more guides/hacks on credit cards and travel.

DBS Points will expire one year from the quarterly period in which they were earned, so it’s not a 24 month validity. Hence I’m reluctant to use this card due to paying the yearly conversion fees or one might narrowly miss out on redeeming the points in the required blocks, esp when travel has been reduced to a halt. This used to be my go to card for air tickets and hotel expenditure (something citi rewards does not cover).

Thank you for pointing it out! I’ve made the edit.