Wouldn’t it be nice to be able to get into a petrol station, fill up your vehicle and know that you are getting the best savings without having to worry about multiple credit card conditions?

The goal of this article is to cut out all the gimmicky cards and simplify your options to receive maximum fuel savings and/or rewards.

The convenience factor

Convenience is a very important factor to consider before deciding on your preferred card or petrol station.

Location

For example, Sinopec offers 20% to 23% discounts periodically without any bank or credit card requirements. However, there are only 3 stations island wide and you’d often find yourself in long vehicle queues to get into the stations.

Credit card conditions

There are many cards out there that advertise high fuel savings but most of them come with multiple conditions that you’d have to continuously keep track of.

Take UOB One‘s 24%-off claim, for example. To receive the advertised fuel saving, this card requires you to pump exactly $60 worth of petrol every single time (at SPC) and spend exactly $2,000 for 3 consecutive months to achieve nothing less than 24% fuel savings.

You should only consider using UOB One for fuel if it’s part of your overall cashback strategy and you prefer Cashback over Miles. Otherwise, there are other combinations that get you similar or better savings without those pesky conditions.

Pay from your vehicle

CaltexGO mobile app allows drivers to pay from the comfort of their own vehicle while still receiving a decent discount. This is very convenient and especially awesome in the social distancing world that we are in right now.

| Subscribe to Suitesmile on Telegram to be the first to know about amazing deals and travel hacks. It's FREE! |

| Subscribe |

Do not ignore fuel prices

It’s not just about card savings or rebates! Fuel prices at SPC are consistently 2% to 3% cheaper than its competitors. This means that you immediately get better value just by choosing the brand!

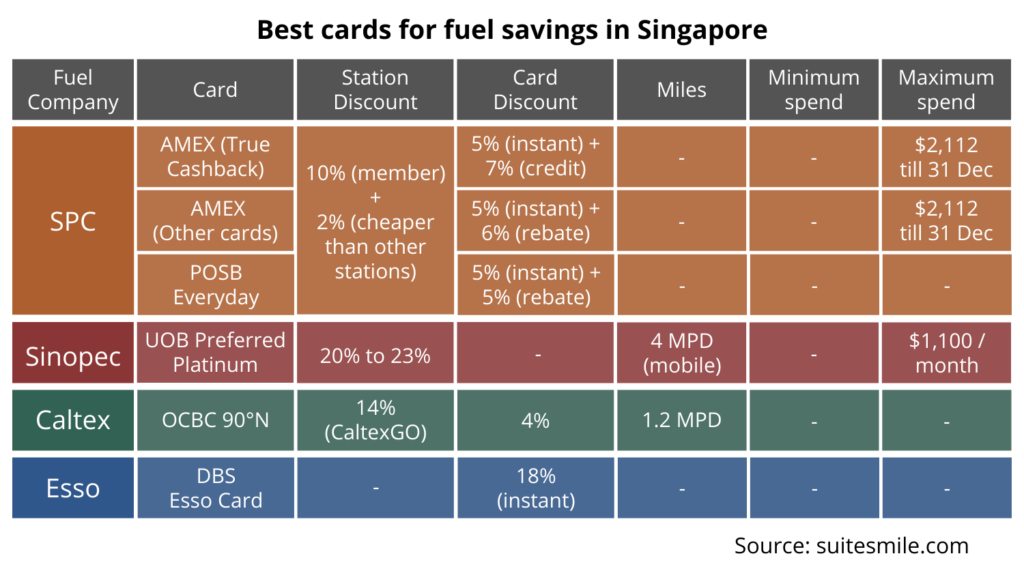

The best combinations

These are the absolute best card + petrol station combinations for maximum savings and rewards on fuel without any minimum spending to worry about. And yes, there’s nothing great at Shell.

Card application links:

- AMEX True Cashback

- AMEX Krisflyer

- POSB Everyday

- UOB Preferred Platinum

- Maybank World

- OCBC 90°N

- DBS Esso Card

Additional points to note:

- Memberships at fuel stations are always free to apply.

- Registration is required to receive the additional 7.1% statement credit with AMEX cards at SPC. Statement credit is capped at $150 per AMEX card ($2,112 nett spending) till 31 Dec 2021. And yes, you can use more than 1 AMEX card to take advantage of this offer.

- Receive 4 MPD with UOB Preferred Platinum only for contactless mobile payments (e.g. Google Pay, Apple Pay).

- To receive fuel discounts at Caltex, make your payment through the CaltexGO mobile app.

- Esso Smiles members also receive the equivalent of 1.7% fuel savings with Smiles points.

If you want a fuss-free solution and get on with your day, you can stop reading here and use AMEX True Cashback at SPC to receive 24% in savings.

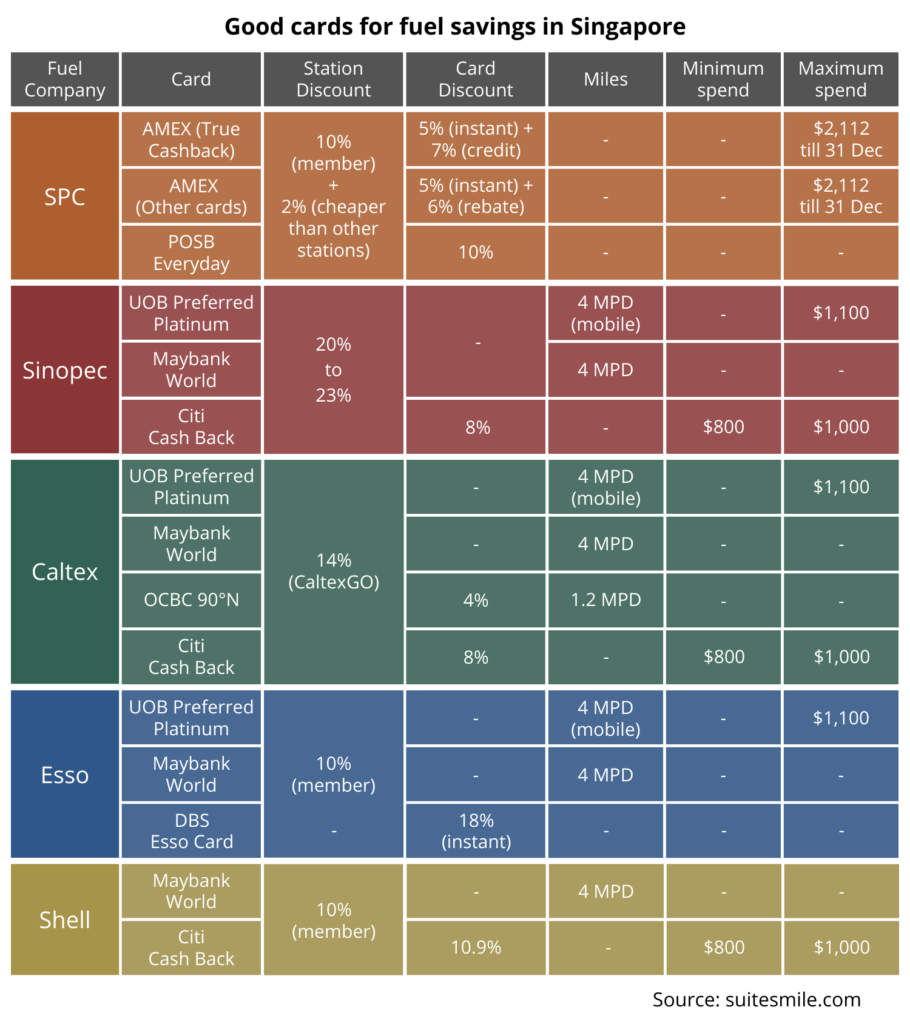

Including decent combinations

This longer list includes decent card + petrol station combinations with conditions that I feel are fairly acceptable.

Card application links:

- AMEX True Cashback

- AMEX Krisflyer

- POSB Everyday

- UOB Preferred Platinum

- Maybank World

- Citi Cash Back

- OCBC 90°N

- DBS Esso Card

Additional points to note:

- Citi Cash Back card offers 8% cashback on petrol, dining and groceries if you spend at least $800 in a statement month. If you can’t meet the minimum spending requirement for that particular month, you can always top up the difference by buying NTUC Fairprice vouchers.

- Maybank World Mastercard has a minimum income requirement of $80,000 a year.

- Maybank World‘s TREATS points can be transferred to Cathay Pacific’s Asia Miles or Singapore Airlines Krisflyer for free (usual cost $26.75). The minimum amount of miles required to transfer out to Asia miles is 5,000 and for Krisflyer, 10,000. This translates to about $1,250 worth of nett fuel spending.

Side-by-side calculations

| AMEX TCB at SPC | Esso Card at Esso | Maybank World at Sinopec | |

|---|---|---|---|

| Fuel quantity | 40 litres | 40 litres | 40 litres |

| Price per litre (Unleaded 95) | $2.41 | $2.46 | $2.46 |

| Gross total | $96.40 | $98.40 | $98.40 |

| Instant savings | -$14.46 (15%) | -$17.70 (18%) | -$20.67 (21%) |

| Total paid | $81.94 | $80.69 | $77.73 |

| Statement credit | -$5.82 (7.1%) | – | – |

| Cashback received | -$1.23 (1.5%) | – | – |

| Miles received | – | – | 308 (worth $5.54) |

| Grand total | $74.89 | $80.69 | $77.73 |

Bonus

Card for riders

Shell Escape Riders Card is a free-to-apply membership card for anyone who rides a motorcycle. It offers 14% (or 16% for V-Power) instant fuel savings at Shell stations. This card is fuss-free but you can only pay with Cash or NETS.

Although Shell calls this “The best thing to happen to bikers since bikes”, you now know that 14% is not good enough. Anyone with a DBS debit card can receive 17% fuel savings at SPC.

Special discount for delivery / passenger drivers

You can receive special fuel discounts at some petrol stations by signing up as a delivery or passenger driver with certain organisations like Grab, GoJek or Lalamove.

For example, as a Grab driver, you can receive 25% off at Sinopec stations and 29% off at Caltex. Even Grab Hitch drivers can enjoy 24% off at Sinopec. Private hire drivers also get to receive 22% fuel discount at SPC.

User rockhaus from Suitesmile Chat Telegram group pointed out that verified Lalamove drivers also get 25% off at Sinopec and 22% off at Shell. To receive these discounts, all you have to do is show your verified profile page on Lalamove’s mobile app! You don’t need to be a full-time Lalamove driver.

On top of these special discounts, you can make the payment with one of the credit cards listed in the tables above to receive miles or cashback.

| Subscribe to Suitesmile on Telegram to be the first to know about amazing deals and travel hacks. It's FREE! |

| Subscribe |

Summary

- Choose any DBS / POSB cards (even debit cards) + SPC if you want fuss-free 17% savings. This is the absolute simplest method. Everyone should at least receive 17% fuel savings in Singapore.

- Choose AMEX cards + SPC if you want about 24% savings without having to worry about minimum spend and long queues.

- Choose POSB Everyday card + SPC if you want consistent 22% savings without having to worry about minimum spend, maximum spend and long queues.

- Choose a 4 MPD card + Sinopec if there’s a station in your way and you don’t mind the long queues.

- Choose Citi Cash Back card + Sinopec for 28% to 31% savings if there’s a station in your way, you don’t mind the long queues and spend between $800 to $1,000 on petrol, groceries and/or dining every month.

Bottom line

This was a complicated spending category to break down, but I’m confident that you’d stay on the winning side with any of the card + petrol station combinations described above.

I used the AMEX + SPC combinations when I had a car in Singapore a couple of years back and I would still do the same today. AMEX True Cashback has been in Suitesmile’s list of the best credit cards in Singapore for a couple of years now.

Some of these savings are pretty close to what we used to get by driving across the causeway! 😜