The absolute best way to maximise your points/miles earning potential is to use the best credit cards for each spending category. With this strategy, you will receive the target 4 miles per dollar (MPD) on almost all your spending.

However, to stay on the winning side, you have to diligently keep track of your credit cards, which can be overwhelming for some.

Don’t have time to read the whole article? Check out this quick slides posted on our Instagram profile:

Why use only 1 credit card?

There are many reasons why someone would prefer to use only 1 credit card for ALL their spending.

Here are the problems that users face when they do not keep track of their credit cards:

Missed annual fees: You should not pay your credit card annual fees, most of the time. However, it can be troublesome to set multiple alerts to call the banks for annual fee waivers throughout the year. Forgetting to waive an annual fee will cause it to accumulate very high interest.

Scattered points/miles: Most banks require a minimum balance of points/miles in your account before you can transfer them out to a frequent flyer program of choice. This can be a hurdle for someone with a low monthly spending (<$1,000) across multiple cards from multiple banks.

Risk of Financial Embarrassment for civil servants: Civil servants in Singapore have a strict set of rules to adhere to to prevent “Financial Embarrassment”. Failing which would cause a negative impact on one’s career path as a civil servant (e.g. promotions and bonuses) in the future.

Newbies: If you are a fresh graduate who have just landed your first job, it is wise to start with only 1 credit card, in order not to get overwhelmed., especially if you are still accessing your financial discipline.

| Subscribe to Suitesmile on Telegram to be the first to know about amazing deals and travel hacks. It's FREE! |

| Subscribe |

Common mistake

If you always wonder why you never have enough miles after spending tens of thousands of dollars over the years, it’s probably because you’ve been using a general spending Miles card!

Instead of earning the target 4 MPD, these cards mostly offer between 1.1 to 1.4 MPD. This means that you will have to spend 3 times more to earn the same amount of miles as a specialised card!

Examples of general spending “Miles” cards are:

Credit cards that are marketed as “Miles” cards should only be used as a last resort in a multi-card miles-earning strategy.

THE credit card

HSBC Revolution Visa card went through major changes last year and I now see it as the best credit card in Singapore.

Here’s why:

No annual fees, ever.

Earn 4 MPD on 2 most popular spending categories, contactless and online, for your first $1,000 spending every month.

Earn miles from your first dollar, unlike UOB credit cards where you only receive points in $5 blocks.

Points expire 3 years after they are earned. (DBS and UOB points expire after 1 and 2 years respectively)

Points can be transferred to two major Frequent Flyer Programs (FFP): Singapore Airlines Krisflyer and Cathay Pacific Asia Miles.

Fantastic sign-up bonus for new cardholders of HSBC: Get $330 cash after spending $500 within the qualifying period (equivalent to 66% cashback).

Fantastic sign-up bonus for existing cardholders of HSBC: Get $60 cash after spending $500 within the qualifying period (equivalent to 12% cashback).

Note: You will earn just 0.4 MPD after exceeding the $1,000 monthly cap.

HSBC Revolution Card

Suitesmile card rating:

Sign-up bonus

(choose one)

$200 cashback,

Samsonite luggage

Key benefit

Earn 4 miles per dollar

or 2.5% cashback

for contactless and online

Annual fee

No annual fee

Min. Income

requirement

$30,000/yr

But…we can’t redeem our points/miles on flights now

Points earned with HSBC Revolution expire 3 years after they are earned.

If you transfer your points to Krisflyer at the end of the 3 years, you will receive 3 more years of miles validity from Singapore Airlines before they expire.

If you transfer those points to Asia Miles instead (which is a better option), your miles can last forever just by having an activity in your account every 18 months. This can be done very easily by purchasing groceries from iHerb through iShop.

What if I prefer a Cashback card?

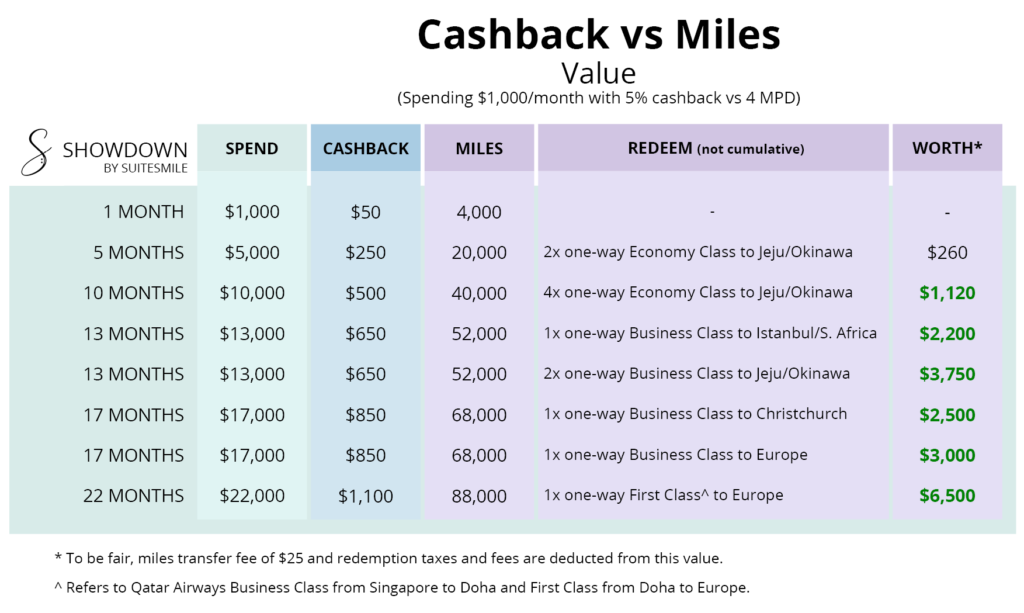

Before you make this decision, check out my article on Cashback vs Miles.

If you still prefer Cashback, your best option, without having to worry about monthly minimum spend, is also the HSBC Revolution! You may choose to redeem your points for an equivalent of 2.5% cashback instead of 4 miles per dollar.

Citibank Cash Back+ Mastercard is another option if you prefer to receive unlimited 1.6% cashback on all spending categories.

Useful articles about credit cards and the Miles Game

As usual, I recommend reading the following articles if you are new to credit cards:

Visit suitesmile.com/learn for more guides/hacks on credit cards and travel.