UPDATE 23 May 2021: Please visit the updated article for 2021.

TL;DR: Use AMEX True Cashback to top up your Grab wallet and use your GrabPay Mastercard to make your payments to receive up to 4.2% of your money back in the form of cashback and points.

Transactions like insurance premiums, school fees and hospital bill payments are excluded from cashback or points programs of most banks in Singapore. This prevents you from using a specialised credit card for maximum miles/points/cashback. While these transactions are not excluded for American Express cards in Singapore, some of those organisations mentioned above do not accept American Express cards (only Mastercard and Visa).

These transactions are usually fairly large, even crossing into five-figures. It will be a waste to not receive any cashback or points for them! Now, before you pull out your NETS card, that will give you absolutely nothing in return, check out the workaround below.

How to do it

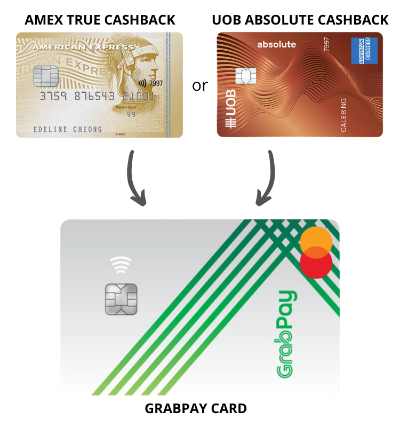

For most transactions, you will want to use a combination of these two cards.

- AMEX True Cashback (credit card)

- GrabPay Mastercard (prepaid debit card)

Using the AMEX True Cashback to top up your GrabPay wallet will get you 1.5% cashback (or 3% on your first $5,000). Once this is done, you will be able to use your GrabPay card to pay for anything you want. The “credit limit” of your GrabPay card is whatever amount that is in your Grab wallet.

If you do not already have a GrabPay Mastercard, check your Grab app for an option to apply for one.

For qualifying payments (not insurance), you will receive 6 Grab points per dollar spent. Hence, a $1,000 payment will get you 6,000 points, which I value at $12. You may simply see this as a 1.2% cashback ($12 / $1,000). Click here to find out ways to use your Grab points for best value.

An extra point to note is, because of MAS regulations, Grab will only allow you to spend a maximum of $5,000 per day. You may need to request whichever organisation that you are paying to for multiple payments over separate days if your bill exceeds this amount. More about this limitation here.

| Subscribe to Suitesmile on Telegram to be the first to know about amazing deals and travel hacks. It's FREE! |

| Subscribe |

American Express sign-up promotion

If you do not already have the American Express True Cashback card, there is a special promotion going on till 2 November 2020. Apply through this link to receive $160 cash after spending $500 within 1 month (Grab wallet top ups counted!).

You will also receive 3% cashback (instead of 1.5% cashback) on your first $5,000 spend within your first 6 months! This 3% welcome bonus is also applicable to existing American Express cardholders who do not currently hold the True Cashback card.

Which transactions give me cashback/points?

Insurance Premiums

You will not receive Grab points for insurance payments. If your insurance company accepts AMEX cards, you may use your AMEX True Cashback card directly to make your payment. Else, top up your Grab wallet and use your GrabPay card for the payment.

Education

Top up your Grab wallet with AMEX True Cashback and pay for your school fees with your GrabPay card to receive both cashback and points.

Hospital/Medical Payments

Top up your Grab wallet with AMEX True Cashback and pay for your hospital/medical payments with your GrabPay card to receive both cashback and points. You may also use the Health Buddy app to make these payments.

| Category | AMEX Cashback | Grab Points |

| Insurance | Yes | No |

| Education | Yes | Yes |

| Hospital | Yes | Yes |

| Utilities | – | Yes |

No credit card, no problem

If you do not qualify for the AMEX True Cashback card, you may also top up your Grab wallet through other means (like PayNow) and still earn Grab points for these transactions.

American Express True Cashback

Suitesmile card rating:

Sign-up bonus

Get $160 cash or

Sony headphones

Key benefit

Get up to 3% cashback

on GrabPay top ups

Annual fee

$171.20

(first year waived)

Min. Income

requirement

$30,000/yr

Bottom line

After multiple devaluations and exclusions here, here, here and here, who knows how long more this workaround will remain. AMEX True Cashback is an important card in my wallet right now and I think everyone should milk the benefits while it lasts.

Useful articles about credit cards and the Miles Game

As usual, I recommend reading the following articles if you are new to credit cards:

inaccurate information. AXS doesn’t accept grabpay anymore since dec-2019

Hi Chongwah, where did I mention AXS?