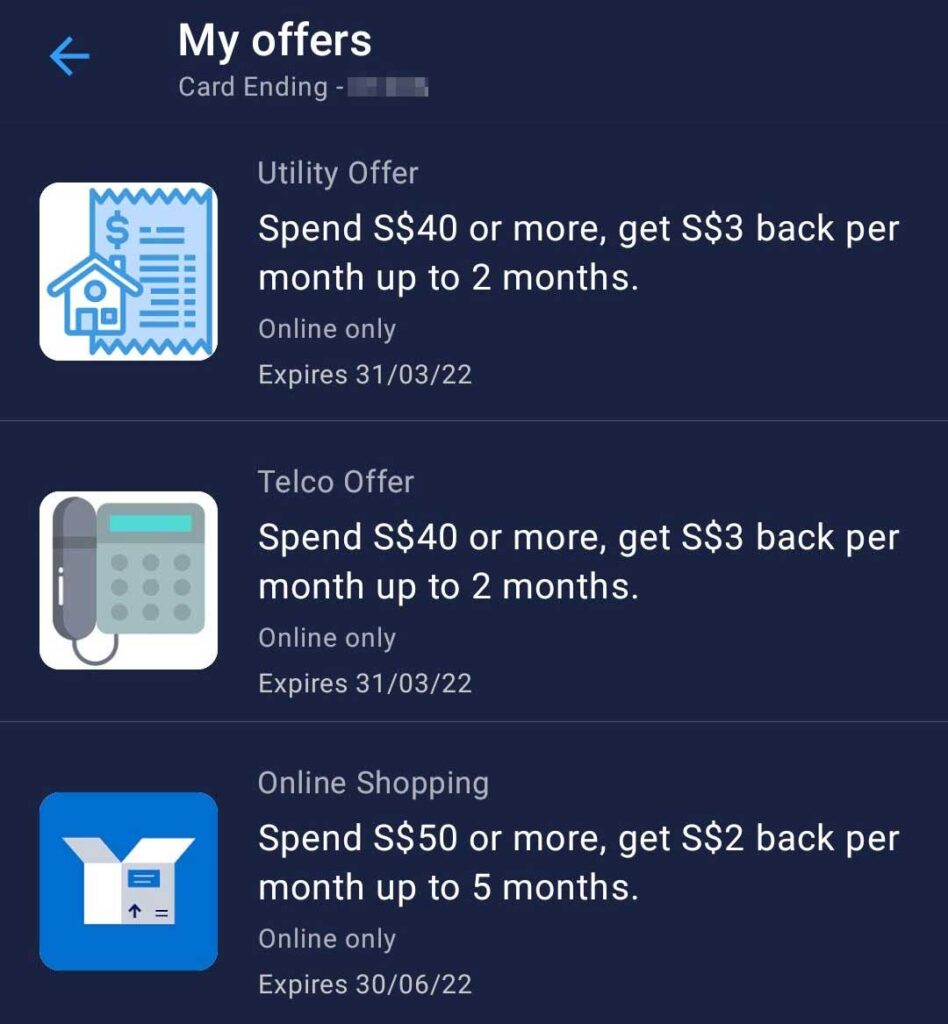

American Express Singapore has released new offers that can be used for the months of February and March 2022.

If you have not saved these offers, you may (should!) do so via your AMEX mobile app or by logging into your account on a web browser.

What’s great is that I am seeing these offers on both my AMEX True Cashback and AMEX Krisflyer cards!

Offer 1: Spend $40 or more on Telco, get $3 back

Offer details: Save offer to eligible Card and spend S$40 or more, in one or more transactions, in-app or online at participating Telco businesses by 31 Mar 2022 to receive one S$3 credit per month up to 2 months. Limited to 50,000 Cards. Exclusions apply.

This offer gives you 7.5% cashback on your telco spending and is the easiest to take advantage of. This is on top of the 1.5% to 3% cashback that you can get on your AMEX True Cashback card.

For my M1 bills, I can make 1x payment of exactly $40 this calendar month and another one next month. Having 2 AMEX cards allows me to have this offer twice a month!

If there are any amounts exceeding $80 a month, I would use the usual combination of Amaze + Citi Rewards to get 4 miles per dollar + 1% cashback for my M1 bills, as described in our page that lists the best credit cards in Singapore.

| Subscribe to Suitesmile on Telegram to be the first to know about amazing deals and travel hacks. It's FREE! |

| Subscribe |

Offer 2: Spend $40 or more on Utilities, get $3 back

Offer details: Save offer to eligible Card and spend S$40 or more, in one or more transactions, in-app or online at participating Utility businesses by 31 Mar 2022 to receive one S$3 credit per month up to 2 months. Limited to 30,000 Cards. Exclusions apply.

This one can be a little tricky to…utilize 😬 in an optimal way.

SP Utilities mobile app allows me to choose the amount that I would like to pay but I found that Senoko Energy does not (I can only pay the full amount billed).

For this reason, I’ll probably only use this offer for water and gas payments on SP as it is a lot less exciting to save $3 on a $150 payment on Senoko!

Looking at the list of participating businesses, I only found that some of them have restrictions on redemption and payment types:

| Service Provider | Redemption Type | Payment Type |

|---|---|---|

| Geneco | Online & In app | One-time payment & Recurring Billing |

| PacificLight | Online only | Recurring Billing only |

| Sembcorp Power | Online & In app | One-time payment & Recurring Billing |

| Senoko Energy | Online & In app | One-time payment & Recurring Billing |

| SP Utilites | Mobile App only | One-time payment & Recurring Billing. Exclude Electric Car Charging and SP Digital Products (GreenUp) |

| Sunseap | Online only | Recurring Billing only |

Offer 3: Spend $50 or more on Online Shopping, get $2 back

Offer details: Save offer to eligible Card and spend S$50 or more, in one or more transactions, in-app or online at Amazon, Lazada, Qoo10 and Shopee by 30 Jun 2022 to receive one S$2 credit per month up to 5 months. Limited to 70,000 Cards. Exclusions apply.

Yawn, I know.

Even if you spend exactly $50, you’ll only be getting 4% cashback. You can 1.5% to 3% cashback on top of that with the AMEX True Cashback too.

However, even with this offer, the Amaze card, when linked correctly, is more rewarding to use for online shopping as you will be getting 4 miles per dollar + 1% cashback.

Offer 4: Additional 4 MPD on Foreign Currency spending

Offer details: Save the offer to your eligible Card and get 4 extra KrisFlyer miles for every S$1 spent, online, in-person or in-app by 31 Mar 2022. Capped at 800 KrisFlyer miles. Limited to 12,000 Cards. Exclusions apply.

This is another unexciting one.

With the AMEX Krisflyer card, you’ll be getting a one-time 5.1 MPD earn rate on just S$200 worth of foreign currency spending.

FAQ: Isn’t that better than what other cards are offering?

Not really.

With the Amaze card, you are able to get 4 MPD + 1% cashback without paying for any foreign currency fees. AMEX charges an FX fee of 2.95%!

On top of that, I value Krisflyer miles substantially lesser than Citi miles because of its lack of flexibility and high-value redemption options.

AMEX sign-up bonuses

Don’t have an AMEX credit card yet? Sign up for one to receive gifts of up to $180 cash or Apple AirPods (Gen 3).

Bottom line

AMEX cards are great for these occasional offers.

Other than that, I only find AMEX True Cashback useful to get up to 3% cashback for Hospital, School or Insurance payments.

I should also mention that AMEX’s customer service is outstanding and in a class of its own, as compared to other Singapore banks!

Do you know of any additional hacks to utilize these offers? Share them on Suitesmile Chat Telegram group!