There’s been some changes since I wrote the 2020 version of this article. Here’s a 2021 update to include UOB’s great new cashback card!

Quick read

Not everything requires a thousand words. Follow Suitesmile on Instagram for more straight-to-the-point slides like these.

| Subscribe to Suitesmile on Telegram to be the first to know about amazing deals and travel hacks. It's FREE! |

| Subscribe |

Commonly excluded categories

Transactions like insurance premiums, school fees and hospital bill payments are common exclusions from cashback and miles/points programs of most banks in Singapore. This prevents anyone from using a specialised credit card for maximum miles/points/cashback.

These transactions are usually larger than usual. It will be a waste to not receive any cashback or points for them. The good news is, there is a workaround!

What cards can I use?

These cards award cashback for Insurance, Education and Hospital payments.

American Express True Cashback

Suitesmile card rating:

SIGN-UP BONUS

3% cashback

Key benefit

Get 1.5% cashback

on almost everything

Annual fee

$171.20

(first year waived)

Min. Income

requirement

$30,000/yr

UOB Absolute Cashback Card

Suitesmile card rating:

Sign-up bonus

$300 cash

Key benefit

Get 1.7% cashback

on all spending

Annual fee

$192.60

(first year waived)

Min. Income

requirement

$30,000/yr

What about AMEX Krisflyer cards?

You may also use AMEX Krisflyer and Krisflyer Ascend for 1.1 and 1.2 MPD respectively on Hospital and Education payments (not Insurance).

However, I do not find both cards attractive as miles are automatically transferred into your Krisflyer account at the end of the month, immediately giving them an expiry date 3 years ahead. I also value Krisflyer miles the lowest among other frequent flyer programs.

What if AMEX is not accepted?

Unfortunately, there are still many organisations that do not accept American Express cards (only Visa and Mastercard). Here’s how you can still receive cashback on transactions made at those places.

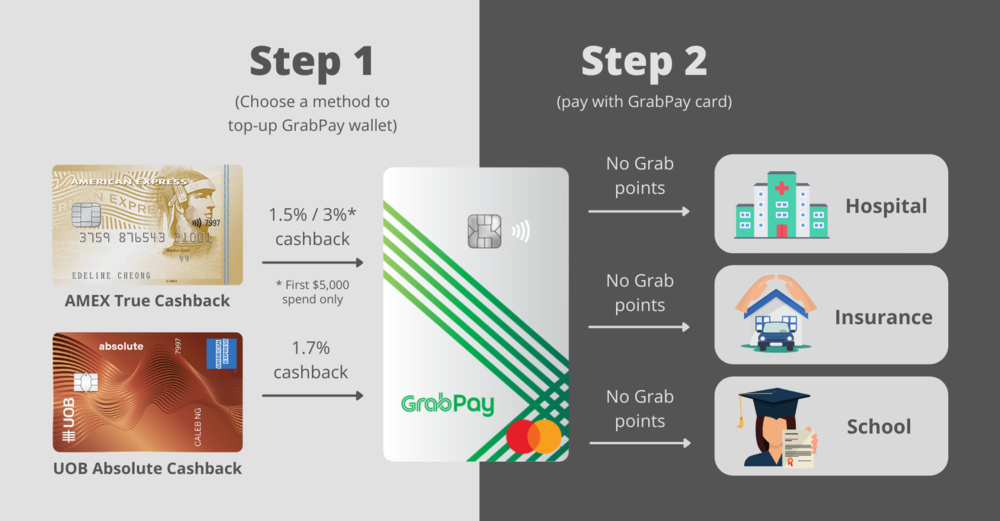

tl;dr: Top-up your GrabPay wallet with AMEX True Cashback for the first $5,000 in 6 months and switch to UOB Absolute Cashback after that.

Start by topping up your GrabPay wallet with either AMEX True Cashback or UOB Absolute Cashback card to receive cashback.

Upon signing up for an AMEX True Cashback card, you will receive 3% cashback on your first $5,000 spent in the first 6 months. You will receive 1.5% cashback after that. There is no minimum or maximum monthly spend to receive 1.5% cashback on GrabPay top-ups!

The all-new UOB Absolute Cashback card will give you 1.7% cashback without minimum or maximum monthly spend too.

Once this is done, you will be able to use your GrabPay Mastercard for payments at any merchant that accepts credit cards.

AMEX

+

GrabPay

Sign-up bonus

3% cashback

Key benefit

Unlock 1.5% cashback

where you usually can’t

Annual fee

$171.20

(first year waived)

Min. Income

requirement

$30,000/yr

Apply for AMEX True Cashback

Apply for GrabPay Card on Grab’s mobile app

GrabPay limitations

An extra point to note is, because of MAS regulations, Grab will only allow you to spend a maximum of $5,000 per day/transaction, $10,000 per month and $30,000* per year.

If your bill exceeds the daily/transaction limit, you may request (the organisation) to make multiple payments over separate days. More about this limitation here.

* May vary depending on individual risk profiles.

Bottom line

The all-new UOB Absolute Cashback card earned its place in my wallet because it offers the highest unlimited cashback with no exclusions. This card has been added to Suitesmile’s list of the best credit cards in Singapore for each spending category.

| Subscribe to Suitesmile on Telegram to be the first to know about amazing deals and travel hacks. It's FREE! |

| Subscribe |

Useful articles about credit cards and the Miles Game

As usual, I recommend reading the following articles if you are new to credit cards:

Is there no grab points for education payments already?

That is right. Official list here: https://help.grab.com/passenger/en-sg/360038831171-What-are-the-transactions-that-DO-NOT-qualify-for-GrabRewards-points