Say you have two credit cards available for an upcoming purchase and both have equal earn rates, which one do you pick? In a situation like this, I would look at how fast the miles/points expire and the number of transfer partners that particular bank has.

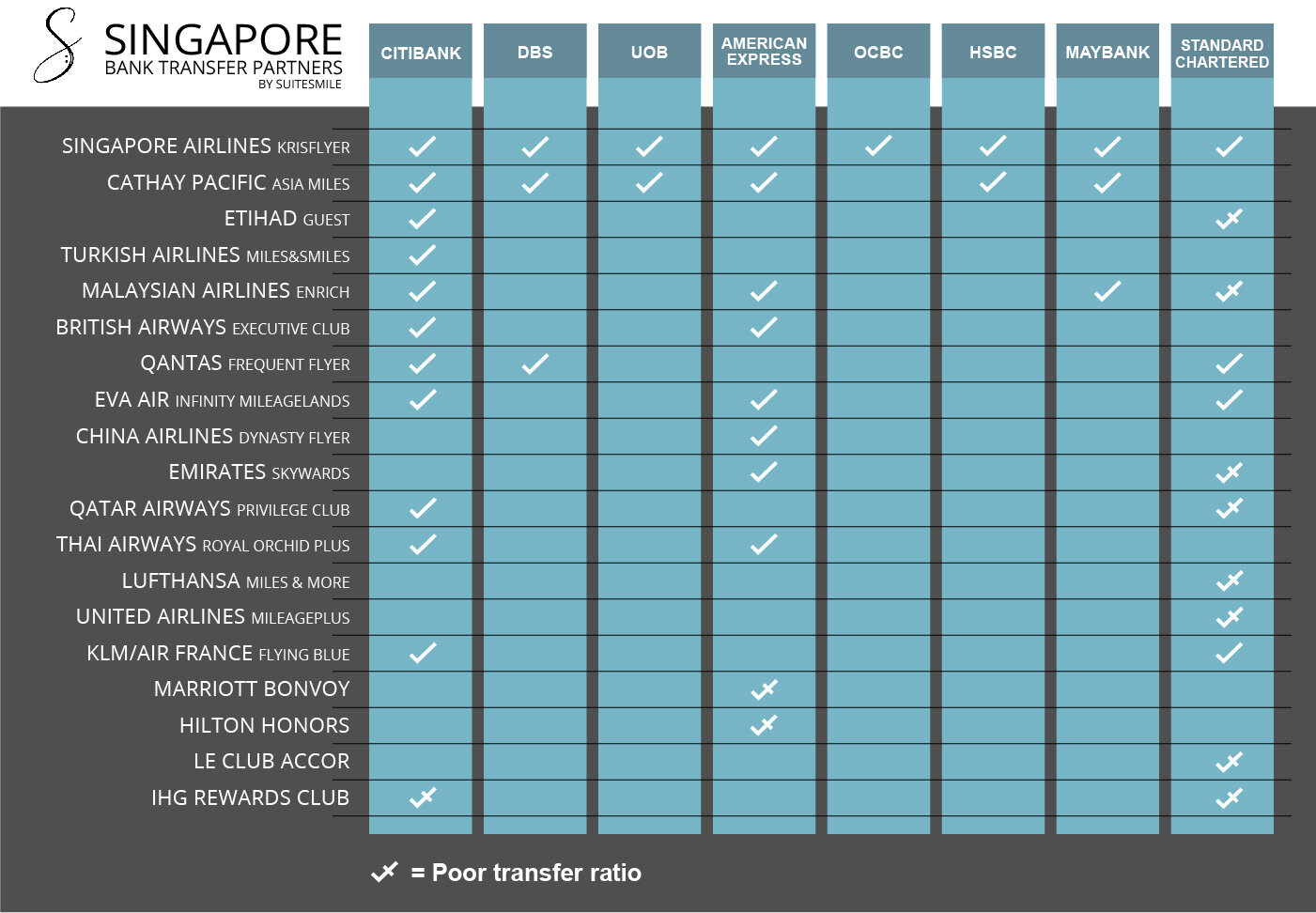

Miles/points transfer partners of banks in Singapore. (Tap/click to enlarge/download)

Examples

1) Buying groceries online:

DBS Woman’s World: 4 MPD

Citibank Rewards: 4 MPD

Easy decision here. I would pick Citibank Rewards as it has much more transfer partners, giving me more options in future.

2) General spending where PayWave is not available.

UOB PRVI: 1.4 MPD

Citibank PremierMiles: 1.2 MPD

DBS Altitude: 1.2 MPD

This one is a little tricky. While UOB’s PRVI offer 0.2 MPD more, its miles expire after 2 years. I will have to transfer the miles to a Frequent Flyer Program (FFP) every now and then to keep it from expiring. Miles earned on Citibank PremierMiles and DBS Altitude do not expire. In this situation, I would take the 0.2 miles cut and use PremierMiles as the miles do not expire and I have a wide choice of transfer partners.

| Subscribe to Suitesmile on Telegram to be the first to know about amazing deals and travel hacks. It's FREE! |

| Subscribe |

Not all partnerships are good

If you have been in the Miles Game for a while, you should know by now that Standard Chartered does not have any credit cards worth keeping. Even the new, poorly launched, X Card offers nothing special in terms of earn rate. Even though Standard Chartered has a lot of transfer partners, most of them have lower transfer ratios that make it not worth transferring your hard-earned miles to.

Where is Bank of China?

It is hard to understand how this bank is still allowed to operate in Singapore. My card application took 2 months, points transfer took 3 weeks and “annual fee waiver” means points deduction to them. Customer service is very poor too. It is just not worth your time. I have experienced the pain and I hope no one else will. In the spirit of writing honest guides and reviews, I am excluding Bank of China from the above graph.

Conclusion

Citibank’s miles and points are, without doubt, the most valuable in Singapore. Click here to look at some attractive credit card sign-up bonuses that give you cash without any spending. And yes, even though Standard Chartered does not offer any credit cards worth keeping in my wallet, they do offer some of the best sign-up bonuses, even for existing customers. It is also worth noting OCBC’s poor list of just one transfer partner. Let’s hope that they add more partners in future.

Follow us on Telegram, Instagram and Facebook to receive our latest updates.

Hi, where is Alaskan Miles that you value a lot in the chart above?

Hi, unfortunately, no Singapore banks have Alaska as a transfer partner yet.

Hi Fairuz,

Admired the way you leverage on credit cards and flight to maximise returns so you can enjoy your holidays in luxury. I will retire next year and will hv lots of free time for travel. Would love to learn more frm you as Im not a budget traveller. Thanks frm KL.

Hi Ramli, thank you for reading! Hope you find something useful in here.