If you are new to the Miles Game, I strongly suggest reading the following articles first:

- Beginner’s Guide to the Miles Game and How to Get Started

Not sure where to start? Here’s a quick guide on the basics of the Miles Game and some challenges that you should be aware of. - What Type of Traveller are you? Is your Travel Pattern a Good Fit for the Miles Game?

The Miles Game is not for everyone. Complete this 13-point checklist, before you embark/continue on this journey!

Have you been earning flexible credit card miles/points? Do you often find yourself wondering which Frequent Flyer Programs (FFPs) you should transfer credit card miles/points to?

“Where should I transfer my credit card miles to?” and “Should I transfer to xxx FFP?” are two of the most frequently asked questions that I see in Suitesmile Chat.

To provide a more comprehensive answer than “it depends”, I feel that it would helpful to have an article to address it.

Why is it important to have award goals?

Having award redemption goals will give you a rough idea of what you want to do with your miles. Remember, you don’t need to have fixed travel plans for the next 3 years, just some goals to aim towards. And feel free to change/adjust those goals along the way!

| Subscribe to Suitesmile on Telegram to be the first to know about amazing deals and travel hacks. It's FREE! |

| Subscribe |

What can go wrong if you don’t have award goals?

Getting into the Miles Game aimlessly can result in you using the wrong credit cards (that do not fit your goals), making poor value award redemptions, or worst, ending up with miles that expire before getting the chance to use them.

Here’s a quick example of a poor award redemption:

There is now less than 2 months to the peak travel season of November/December and you would like to book a trip to Europe using miles, for a family of 4.

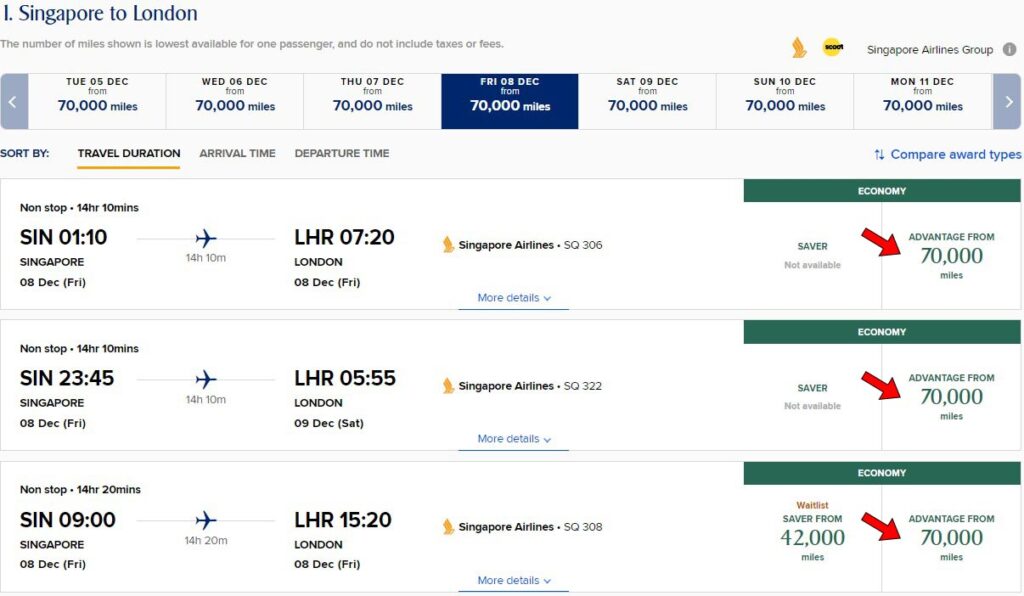

If you’ve been dumping all your credit card miles/points to KrisFlyer without evaluating your award goals, you would see the following options on singaporeair.com:

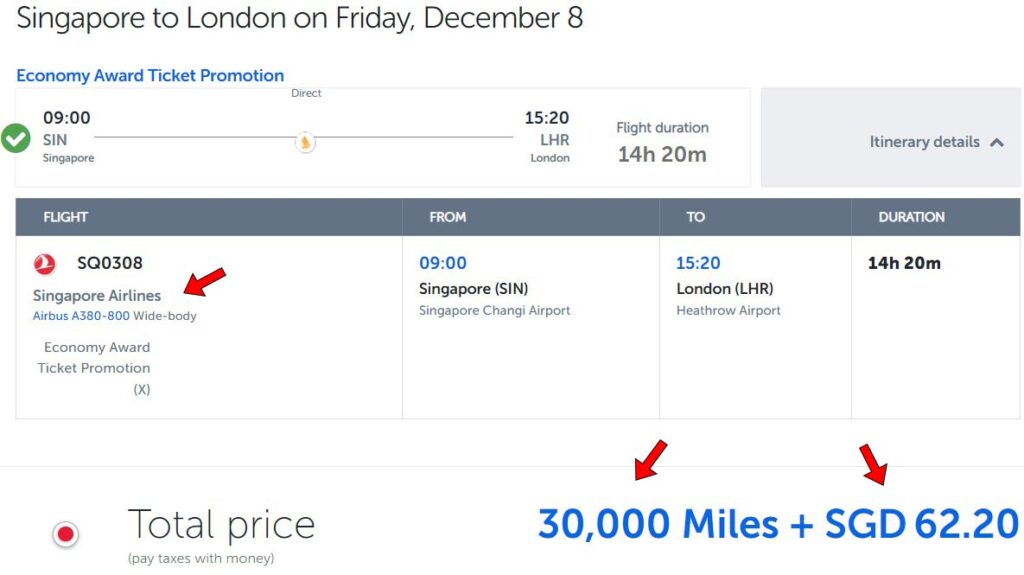

If you’ve been earning miles through Citi cards, you would also have the option to book the same flight through Turkish Airlines Miles&Smiles; where it would cost 40k fewer miles for a flight on the exact same plane, on the same date/time, with the same taxes/fees!

Related: Cheapest ways to fly between Singapore and Europe using Miles/Points from Singapore cards

Finding out your award goals

To decide on award goals, ask yourself these questions:

- Where do I want to travel to, in the next 2-3 years?

- Am I aware of the amount of miles required from different FFPs for those routes?

- Are there any award sweet spots that offer better value for those routes?

- Which cabin class am I aiming for (Economy/Business/First)?

- How’s the general award availability like, to/from that city?

- What’s my travel pattern like?

- How many passengers do I want to redeem for (solo/couple/family)?

- Which airline(s) do I want to fly with?

- Am I okay with having layovers (non-direct flights)?

- Am I okay with repositioning?

A few more things to note

Keep miles/points in your card

The general advice is to keep your miles/points in your credit cards for as long as possible, until you are ready to transfer to an FFP and make an award booking. This is because, every FFP has its own quirks and annoyances.

This is of course, much easier with cards like Citi PremierMiles, Citi Prestige and Standard Chartered Journey where miles are ultra-flexible and never expire.

Points pooling

There is also a common argument about miles/points pooling — the ability to combine miles/points from different cards of the same bank.

Having miles/points that do not pool can lead to “wasting” ~S$25 in transfer fees, when converting to miles individually from each card. It can also lead to members having “orphan” miles that cannot be transferred out as they do not meet the minimum transfer block (typically 10k miles).

Personally, I see it as a small cost of being in the Miles Game. I wouldn’t lose sleep over an additional S$25 in conversion fee or the occasional 5,000 “orphan” miles, when I know that in the long run, most of my credit card miles are flexible and give me fantastic award redemption options in future.

Points pooling information can be found by clicking on the + More info buttons in Suitesmile’s credit card page.

| Subscribe to Suitesmile on Telegram to be the first to know about amazing deals and travel hacks. It's FREE! |

| Subscribe |

What are my award goals?

I enjoy trying out Business/First Class products of different airlines, and I have a long wish list of products that I would like to fly in.

I should also mention that as a blogger/content-creator, there’s an additional incentive in sharing reviews/photos of more airline products, instead of simply flying from point A to point B in any Business Class.

If you are interested to know, here’s my current wish list (top 5):

- ANA THE Room Business Class (Miles&Smiles: Tokyo to London)

- STARLUX Airbus A350 Business Class (Alaska: Taipei to Tokyo)

- Singapore Airlines Boeing 737-8 MAX Business Class (KrisFlyer: Singapore to Hanoi)

- Lufthansa Boeing 747-8 First Class (Lifemiles: Frankfurt to Bengaluru)

- Qantas A380 First Class (Qantas FF: Singapore to Sydney)

On top of getting new flying experiences, I would also like to redeem miles (in Business/First Class) for future trips to regions like:

- North Asia (Infinity MileageLands/Alaska/Flying Blue)

- Oceania (KrisFlyer/Qantas FF)

- Europe (Asia Miles/Miles&Smiles/Privilege Club/Infinity MileageLands/Flying Blue)

- Central Asia (Miles&Smiles/Privilege Club)

Additional note: I am comfortable flying with budget airlines, for flights under 3 hours. I do not see much value in redeeming miles or paying 2 to 3 times more for a full-service airline on short flights.

Bottom line

There is no perfect FFP for everyone, and there is no one FFP that would suit all of a traveller’s needs.

It is important to have a rough idea of what you want to do with those miles; not just using the highest “mpd” cards to earn as much of them as possible, regardless of how flexible the miles are.

I hope that this article answers your question of “Which FFP should I transfer my credit cards miles to?”.

Is there a way to check for availability ? I seem to have a hard time getting any award tickets on preferred airline/program.

Do you transfer from CC>program miles before or after you found an ideal route to redeem?

You can check for award availability on the respective FFP’s website.

For partner oneworld award space, you can find them much faster through the calendar view on aa.com. For star alliance, use united.com or lifemiles.com.

There are also third-party tools like seats.aero.

I always transfer from CC>FFP after finding award availability on a preferred route.