Singapore Airlines is running great deals for flights departing Jakarta, Indonesia and Kuala Lumpur, Malaysia.

Great deals from Jakarta, Indonesia

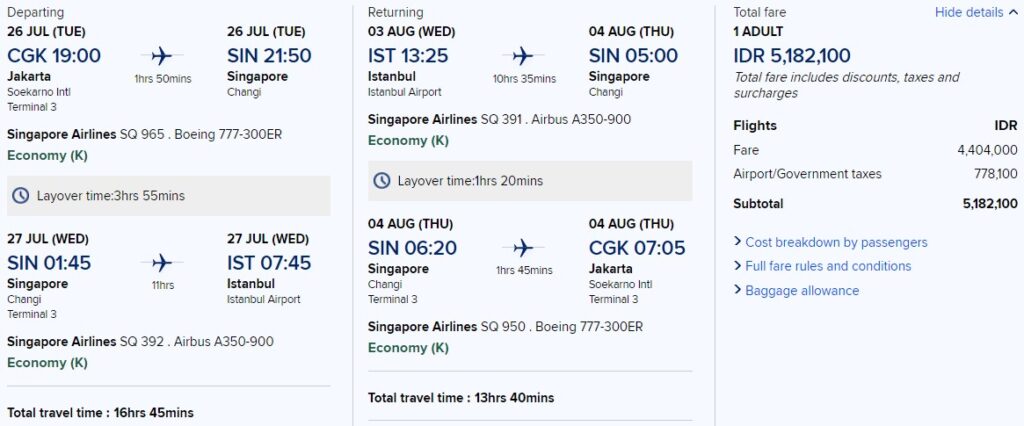

Fares reflected below are for roundtrip flights and can be found for travel up till September 2022.

| Jakarta to | Class | Price | Earn miles |

|---|---|---|---|

| Istanbul | Economy | IDR 5.2m (S$489) | 5,950 SQ (worth S$104) |

| Istanbul | Premium Economy* | IDR 11m (S$1,038) | 11,900 SQ (worth S$210) 11,600 AS (worth S$236) |

| Istanbul, Amsterdam, Paris | Business | from IDR 25.5m (S$2,413) | 14,900 SQ (worth S$264) 23,800 AS (worth S$485) |

*The short legs between Singapore and Jakarta will be in Economy Class.

| Subscribe to Suitesmile on Telegram to be the first to know about amazing deals and travel hacks. It's FREE! |

| Subscribe |

Great deals from Kuala Lumpur, Malaysia

Fares reflected below are for roundtrip flights and can be found for travel up till September 2022.

Unfortunately, there are no good Premium Economy or Business Class fares from Kuala Lumpur.

| Kuala Lumpur to | Class | Price | Earn miles |

|---|---|---|---|

| Istanbul | Economy | MYR 1,700 (S$546) | 5,550 SQ (worth S$98) |

| Zurich | Economy | MYR 1,940 (S$623) | 6,600 SQ (worth S$117) |

| Amsterdam | Economy | MYR 2,300 (S$738) | 6,700 SQ (worth S$118) |

Best Singapore cards to book flight tickets

Additional note: To get 4 MPD with the Amaze card, you should link it with DBS Woman’s World Mastercard (NOT Citi Rewards).

Amaze Card

Suitesmile card rating:

SIGN-UP BONUS

Get 225 InstaPoints

(worth $2.25)

Key benefit

Earn 4 miles per dollar

and 1% cashback

without FX fees

Annual fee

No annual fee

Min. Income

requirement

–

We recommend linking the following

credit cards to your Amaze card:

Citi Rewards

Citi PremierMiles

DBS Woman’s World Card

Suitesmile card rating:

Sign-up bonus

$150 cashback

Key benefit

Earn 4 miles per dollar

for online spending

Annual fee

$192.60

(first year waived)

Min. Income

requirement

$80,000/yr

(not strict)

DBS Altitude Visa Card

Suitesmile card rating:

Sign-up bonus

Get up to

34,000 miles

Key benefit

Earn 3 MPD on

online flight and

hotel bookings

Annual fee

$192.60

(first year waived)

Min. Income

requirement

$30,000/yr

Bottom line

The Economy and Premium Economy prices shared above are fantastic as Singapore Airlines include checked baggage for their promotional fares.

If you are based in Jakarta or Kuala Lumpur, this is a great reason to visit Europe in the Summer!

If you are based in Singapore, consider the positioning costs that you will incur to get to and fly home from Jakarta or Kuala Lumpur.

Out of curiousity, why shouldnt one link Amaze card with Citi rewards? both dbs ww and citi rewards are entitled for 4mpd isnt it

Awesome sharing, thanks for the tips !