From 1 August 2020, HSBC Revolution Visa card will get you 10X rewards points (4 miles per dollar) on online and contactless payments. Both are highly important categories for card users as they make up the bulk of our spending.

This new earn rate only applies on your first $1,000 of spending and this is a combined limit between both categories. As shown in HSBC’s illustration below, the maximum number of bonus points you can receive per month is 9,000. There will be no minimum monthly spend. You will receive this lovely earn rate from your first dollar.

How does it compare to existing cards in the Online category?

In the Online spending category, HSBC Revolution is going head to head with Citibank Rewards and DBS Woman’s World. According to the terms and conditions, HSBC Revolution will cover a wide range of MCC codes for online spending. This makes it better than Citibank Rewards, which excludes online travel spending. The only clear difference between HSBC Revolution and DBS Woman’s World is the monthly limit to receive 4 MPD. The latter offers a higher limit of $2,000.

With all that in mind, I will still pick Citibank Rewards for non-travel online spending because of its long list of transfer partners. I will also continue to use DBS Woman’s World for my first $2,000 online spend and then HSBC Revolution for the next $1,000.

| Subscribe to Suitesmile on Telegram to be the first to know about amazing deals and travel hacks. It's FREE! |

| Subscribe |

How does it compare to existing cards in the Contactless category?

UOB Preferred Platinum (PPV) has been the king in this category for many years now and it’s great to have a new challenger. Right off the bat, HSBC Revolution beats UOB PPV as it awards points from your first dollar. UOB only awards points in $5 blocks. And unlike UOB PPV, you do not need to use your mobile phone to earn the bonus earn rate. Tapping the physical card to the payment terminal would qualify.

No more annual fee!

With this revamp, there will not be annual fees on this card anymore. Not that you should pay your annual fee anyway but this means one less date to track!

Transfer partners

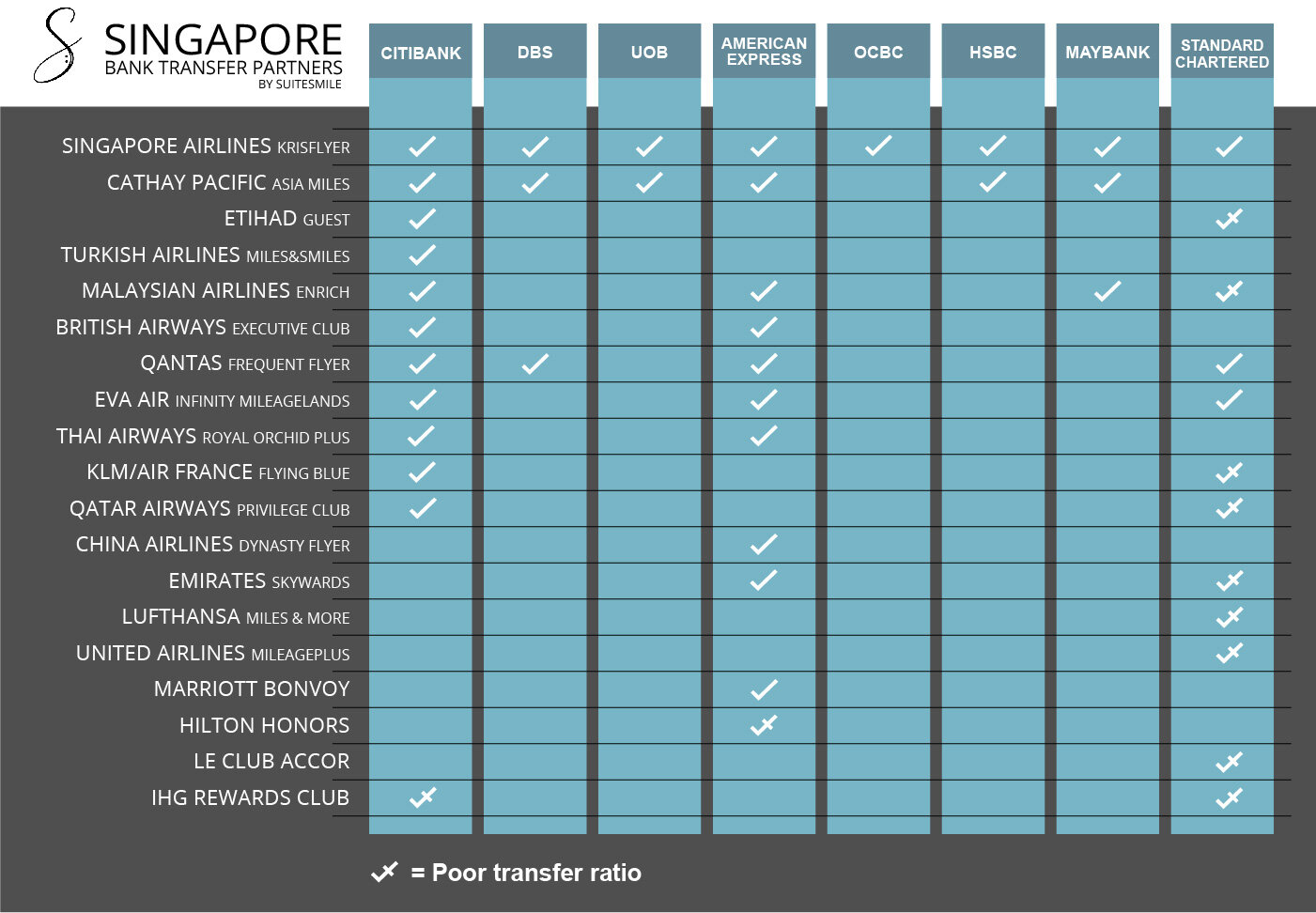

HSBC points can be transferred to Singapore Airlines Krisflyer and Cathay Pacific Asia Miles as shown in our dedicated page of bank transfer partners.

Bank transfer partners

Sign-up bonus

If you have $800 worth of retail spending in the coming month and are new to HSBC, you may choose to receive either a Samsonite luggage worth $670 or $150 cash. Click here to find out more about this promotion!

Conclusion

This card went from being a “nice back-up” to a must-have real quick. Well, not that quick. You will still have to wait till 1 August 2020. Hence, I will not be updating the dedicated page for the best cards for each category just yet to avoid confusion. Because this card does not have an annual fee anymore, every one who is serious about chasing miles must have it in their wallet.

Follow us on Telegram, Instagram and Facebook to receive our latest updates.

the key downside to HSBC Revo is that it works on a whitelist basis as compared to a blacklist basis adopted by UOB PPV. Whitelisted merchants are fewer in my opinion.